Growth Equity

SRI Quality Growth

Actively managed equity strategy.

Socially responsible investing viewed through a common-sense lens.

Growth Equity

SRI Quality Growth Equity Strategy

Best Ideas portfolio with large cap growth style consistency.

- Focused portfolio of around 30-40 publicly traded high-quality stocks

- High conviction, and low portfolio turnover approach

- Proactive sell-discipline

- “Price follows earnings” philosophy seeks companies with the ability to consistently grow top- and bottom-line earnings

JAG’s experienced, entrepreneurial portfolio management team seeks to add value by curating a portfolio of multinational firms with wide competitive moats, consistent profitability, and strong balance sheets that we believe are not overly reliant on the economic cycle.

Discover The Latest Insights

Stay up-to-date with reports and insights from our analysts and practice leaders.

2nd Quarter 2024: The Concentration Conundrum

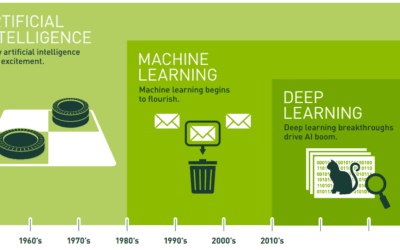

The Concentration Conundrum Enthusiasm for Artificial Intelligence (AI) once again powered the broad market higher last quarter, as the S&P 500 generated...

JAG Growth Equity Thematic Insights: Q2 2024

June 2024 Summary "Creative destruction" is a feature of capitalism and the modern global economy. The forces of innovation push society forward and...

1st Quarter 2024: Time Flies

Reflecting on 25 Years March 8th marked the 25th anniversary of my first day at JAG. In early 1999, my wife Chris and I had just turned 30 years old. Back...

Strive For More with Large Cap Growth

View the Quarterly Fact Sheet for detailed information.