Investment Strategies

Growth Equity Investment Strategies

Invest alongside us in innovative and sustainable growth companies.

Plan for the Future with a Growth Equity Investment Strategy

With a sustainable growth equity investment strategy, you’re invested in growth companies that are driving the evolution of the global economy, improving society, and meeting long-term goals for investors.

Disciplined Process

Optimize your portfolio with a team committed to a proven, repeatable process for identifying and capitalizing on high-growth opportunities.

Active Investments

Make sure your portfolio is ready to adapt to market conditions and new opportunities by leveraging an active investment advisory firm.

Price Appreciation Goals

Use a portfolio of individual stocks that exhibit high growth characteristics and offer compelling price appreciation potential to grow your investments.

Learn more about our focused and diversified growth equity portfolios.

Large Cap Growth

The strategy focuses primarily on U.S. Large Cap companies that exhibit fundamental strength, superior growth characteristics and reasonable valuations.

Small Mid Cap Growth

The strategy invests in high-quality, innovative and transformative companies significantly growing sales and market share. Best ideas portfolio with small and mid cap growth style consistency.

SRI Quality Growth

Socially responsible investing viewed through a common-sense lens. The strategy focuses on multinational companies with wide competitive moats, consistent profitability, and strong balance sheets that we believe are not overly reliant on the economic cycle.

Custom Portfolios

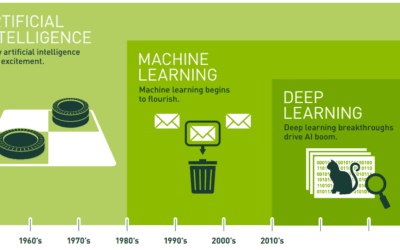

Portfolios with a highly concentrated focus designed for clients with long-term goals. These include growth companies deriving the majority of their revenues from international business activity and companies driving growth through disruptive technologies and innovation.

Discover How We Design Growth Equity Portfolios

Devising a growth equity investment strategy that aims to exceed market expectations takes experience, process, and a keen understanding of what qualities demonstrate opportunities. We identify stocks that exhibit:

- Superior growth characteristics

- Solid fundamentals

- Compelling price appreciation

In doing so, we create strategies that strive to outperform and benefit you, our clients.

Get The Most from Your Investments

We strive to meet your goals.

Don’t settle for average. With our growth equity strategies, we’re working to exceed the market expectations and capitalize on market opportunities for your benefit.

Stay Up-to-Date on Market News

Check out our quarterly commentary and blog for insightful capital management news.

1st Quarter 2024: Time Flies

Reflecting on 25 Years March 8th marked the 25th anniversary of my first day at JAG. In early 1999, my wife Chris and I had just turned 30 years old. Back...

JAG Team Insights — Q1 2024: Thematic Insights

April 2024 Summary Esteemed investor Howard Marks once said, "We may never know where we're going, but we sure out to know where we are." We agree with Mr....

4th Quarter 2023: A Catalyst-Driven Rally for Investors

Market Overview Stocks enjoyed a broad and powerful rally in the fourth quarter as the major US stock indices posted strong quarterly gains, including the...

Strive For More with Growth Equity Strategies

Expand the possibilities by investing in growth equity strategies that demonstrate qualitative value.