Investment Strategies

Fixed Income Investment Strategies

Manage and mitigate risk while striving to maximize your total returns with intermediate fixed income investment strategies.

Choose A Steadfast and Stable Intermediate Fixed Income Strategy Firm

We believe bond portfolios should provide you with stability, consistency, and income. Our taxable intermediate fixed income solutions seek to maximize your total returns while mitigating risk.

Intermediate-Term Duration

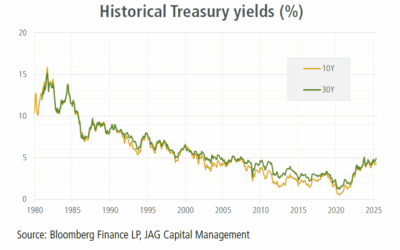

Insulate portfolios from potentially incorrect active yield-curve bets relative to the benchmark with a consistent +/- 1-year duration profile — regardless of the yield-curve backdrop.

Exposure to Corporate Credit

Focused, Security-Specific Portfolios

Seek a Reliable Source of Income

Your investment team helps you mitigate risk while seeking maximum returns.

We’re value-centric bond investors. Our bottom-up, research-driven investment process results in focused and diversified portfolios of individual bonds that strive to deliver a reliable source of portfolio income for you while minimizing interest rate risk.

Balance Risk and Reward with Research-Driven Intermediate Fixed Income Investments

Each portfolio position we take seeks to compensate for the risk we assume as creditors. Our credit research process focuses on mitigating the risk of permanent loss of capital — a common occurrence during bankruptcy or restructuring events. Choose intermediate fixed income strategies from a team that examines all of the factors: cash flow source, cash flow use, balance sheet strength, capital structure transparency, sales and EBITDA trends, and more.

Sustainable Intermediate Fixed Income Firm Options

For select, qualified clients, JAG Capital Management offers separately managed portfolios with customizable duration, credit quality, and ESG and SRI characteristics.

See for Yourself the Opportunity Posed by Intermediate Fixed Income Strategies

Explore the past performance of our intermediate fixed income strategies and find out just what exceeding expectations can look like.

Stay Up-to-Date on Market News

Check out our quarterly commentary and blog for insightful capital management news.

A St. Louis-Based Firm With a Nationally Recognized Investment Strategy

JAG's Large Cap Growth strategy named a PSN Bull & Bear Masters top 10 performer (3-year period ending 3/31/25) At JAG, we actively manage equity...

JAG Growth Equity Thematic Insights: Q2 2025

June 2025 Investing in Transformation That Matters Beyond the Headlines, the AI Revolution Continues Although tariff policy, government spending, and politics...

JAG Fixed Income Thematic Insights: Q2 2025

June 2025 - Treasury Market Primer: Back to Textbook Basics? Summary As we enter the final weeks of Q2 - and at the risk of speaking too soon - several key...

Seek Consistent and Reliable Total Returns

With a portfolio built by a research-driven intermediate fixed income firm, you create stable growth potential.