Institutions

Prudent Investment Oversight for Religious Institutions

We are a committed fiduciary and partner in your stewardship efforts. We believe active investing, informed by independent thinking, gives your organization the best possibility of achieving superior investment returns.

Align Your Organization’s Investments to Your Mission

Our foundation is you.

Since 1945, we have focused on providing investment products and services that seek to preserve capital, provide income for current needs, growth for future needs, and incorporate ethical standards into the investment management process.

Our longstanding history of working with religious institutions gives us a unique perspective and advantage in our work.

Meet Sandy Shotwell-Cain, Vice President & Director of Institutional Client Service | 3:11

Mission Driven

We understand growing social and financial capital is a driving force behind your organization’s investment goals

Client Focused

We endeavor to act as an extension of our clients’ staff and we encourage our clients to rely upon us to help solve problems and streamline processes.

Customizable and Flexible

Our expertise and technology allow us to interpret, integrate, and implement complex social guidelines into our investment portfolios.

Uncomplicated

We believe that focused portfolios of individual stocks and bonds can be utilized to generate growth of principal and cash flow to long-term investors.

Socially Responsible Capabilities for Religious Organizations

Portfolio solutions aligned with your investment objectives.

For many religious clients, we customize our SRI screens based upon specific individual guidelines. Our firm also has a decades-long history of avoiding the ownership of equity positions in shares of companies engaged in the manufacture of distilled spirits, tobacco products, and offensive weaponry. Many of our religious clients have zero tolerance policies on their exclusionary screens, however our suite of tools allows us to use specific revenue thresholds if a client prefers to take a revenue level “worst offenders” based approach to exclusions.

Discover The Latest Insights

Stay up-to-date with reports and insights from our analysts and practice leaders.

A St. Louis-Based Firm With a Nationally Recognized Investment Strategy

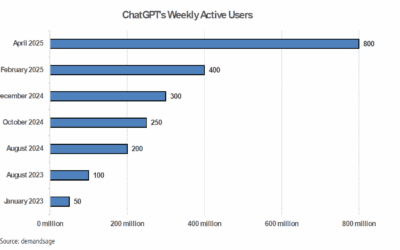

JAG's Large Cap Growth strategy named a PSN Bull & Bear Masters top 10 performer (3-year period ending 3/31/25) At JAG, we actively manage equity...

JAG Growth Equity Thematic Insights: Q2 2025

June 2025 Investing in Transformation That Matters Beyond the Headlines, the AI Revolution Continues Although tariff policy, government spending, and politics...

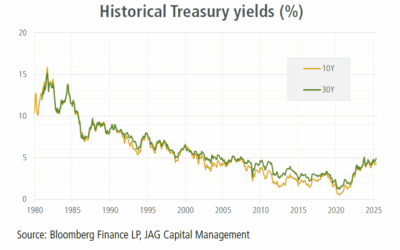

JAG Fixed Income Thematic Insights: Q2 2025

June 2025 - Treasury Market Primer: Back to Textbook Basics? Summary As we enter the final weeks of Q2 - and at the risk of speaking too soon - several key...

Give Your Organization the Care it Deserves

Use our carefully-curated, process-driven investment strategies to reach your long-term investment goals.