Active Investment Management for

Advisors and Consultants

Providing outstanding solutions and service to you and your client-base with a transparent and accessible team.

Seek More Than A Product

Partner with a team experienced in working directly with Advisors and Consultants.

Our relationship-based approach helps solve problems you face when navigating the market on behalf of your clients. Our team listens to your needs and takes this into consideration before recommending a solution. Our ability to customize any of our active investment solutions helps fill those needs, while providing a consistent and disciplined investment approach that fits your needs and objectives.

Meet James Sindelar, Senior Vice President, Strategic Relationships | 3:02

Gain Transparency

When your next quarterly meeting arrives, you’ll already know how your portfolio is performing, and how it is positioned going forward.

Experience Accessibility

Our team is your team, and we’re always available — anytime, anywhere — to offer support and service.

Create Flexibility

We provide the flexibility to customize our portfolios to take advantage of your client’s unique goals.

Stay Disciplined

Access focused and active investment strategies that follow disciplined and repeatable processes with an emphasis on risk management.

Feel Confident Working with a Responsive and Accessible Portfolio Management Team

You are a priority.

When you have a question, you deserve a timely response. Markets are variable, service should be consistent. Our experienced institutional service team and portfolio managers are always accessible and provide a valuable voice when communicating with boards, investment committees, and stakeholders.

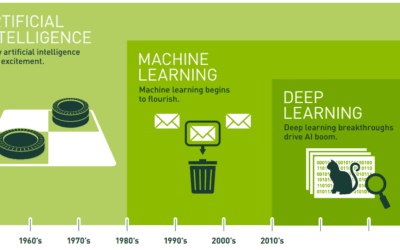

Get More than a Data Point. Get Value-Added Research Insights.

Data is everywhere. What you need is insight. Get the news filtered down to the essentials, so you can stay informed about what’s important.

1st Quarter 2024: Time Flies

Reflecting on 25 Years March 8th marked the 25th anniversary of my first day at JAG. In early 1999, my wife Chris and I had just turned 30 years old. Back...

JAG Team Insights — Q1 2024: Thematic Insights

April 2024 Summary Esteemed investor Howard Marks once said, "We may never know where we're going, but we sure out to know where we are." We agree with Mr....

4th Quarter 2023: A Catalyst-Driven Rally for Investors

Market Overview Stocks enjoyed a broad and powerful rally in the fourth quarter as the major US stock indices posted strong quarterly gains, including the...

Give Your Organization the Care it Deserves

Use our carefully-curated, process-driven investment strategies to reach your long-term investment goals.