Investment Strategies

Explore our independently-curated active investment strategies.

Expect More with Active Investment Strategies

Invest in individual companies, hand-selected by our expert analysts.

Curated Portfolios

Partner with an active advisory firm, with analysts who constantly monitor and improve portfolios to maximize long-term returns.

Our Strategies are Our Own

“We eat our own cooking.” Our strategies are developed in-house and used by members of the JAG team for our own investments.

Striving to Meet Your Goals

Our portfolios and performance are not beholden to benchmarks; instead, we aim to add value by finding and exploiting opportunities.

Structured around Opportunities

Capitalize on opportunities with a portfolio strategically built around high-quality growth equity investments & value-centric fixed income investments.

Tech-supported Investments

Our intentional use of technology enables the investment team to make timely and prudent decisions.

Simple. Made to Work.

Minimize Cognitive Bias with Process-Driven Portfolio Curation

Make smarter investment decisions.

Anyone can invest in stocks and attend to the daily influx of data, but our analysts know how to filter that data, silence bias, and make non-emotional decisions that aim to create wealth for our clients.

Meet Norm Conley, CEO & CIO | 3:18

Explore Our Active Investment Strategies

Find a carefully-curated, active investment strategy that aligns to your long-term needs.

Growth Equity Strategies

Seek compelling price appreciation potential with our growth equity strategies.

Fixed Income Strategies

Mitigate interest rate risk with our steadfastly intermediate duration fixed income solutions.

ESG & SRI Investing

Customize your portfolio with specific socially responsible and environmental, social, and governance guidelines.

Culture of Service

We have always believed that our commitment to delivering superior service is an important differentiator.

“In practice, this means that we commit to making our investment decision-makers accessible and accountable to all of our clients. Our focused staff and our flat, client-facing organizational structure support our goals of delivering superb service—every day and all the time. We view ourselves as an extension of our clients’ professional staff and encourage them to rely upon us to help solve problems and streamline processes.”

Norm Conley

CEO & Chief Investment Officer

Rely on Tested Processes and a Drive to Succeed

Partner with advisors and analysts experienced in assessing the markets and finding opportunities from which you benefit.

Filter The Data

The amount of data available is overwhelming, which is why working with a partner who knows how to sift through incoming information is so important.

Identify Opportunities

Take Actionable Steps

Build Active Portfolios

We aim to create active investment strategies that take advantage of opportunities and market conditions to best serve our clients.

Adapt to New Insights

Stay Up-to-Date on Market News

Check out our quarterly commentary and blog for insightful capital management news.

2nd Quarter 2024: The Concentration Conundrum

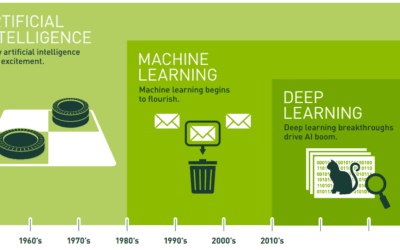

The Concentration Conundrum Enthusiasm for Artificial Intelligence (AI) once again powered the broad market higher last quarter, as the S&P 500 generated...

JAG Growth Equity Thematic Insights: Q2 2024

June 2024 Summary "Creative destruction" is a feature of capitalism and the modern global economy. The forces of innovation push society forward and...

1st Quarter 2024: Time Flies

Reflecting on 25 Years March 8th marked the 25th anniversary of my first day at JAG. In early 1999, my wife Chris and I had just turned 30 years old. Back...

Invest with Confidence in our Active Investment Strategies

Use our process-driven investment strategies to reach your long-term investment goals.