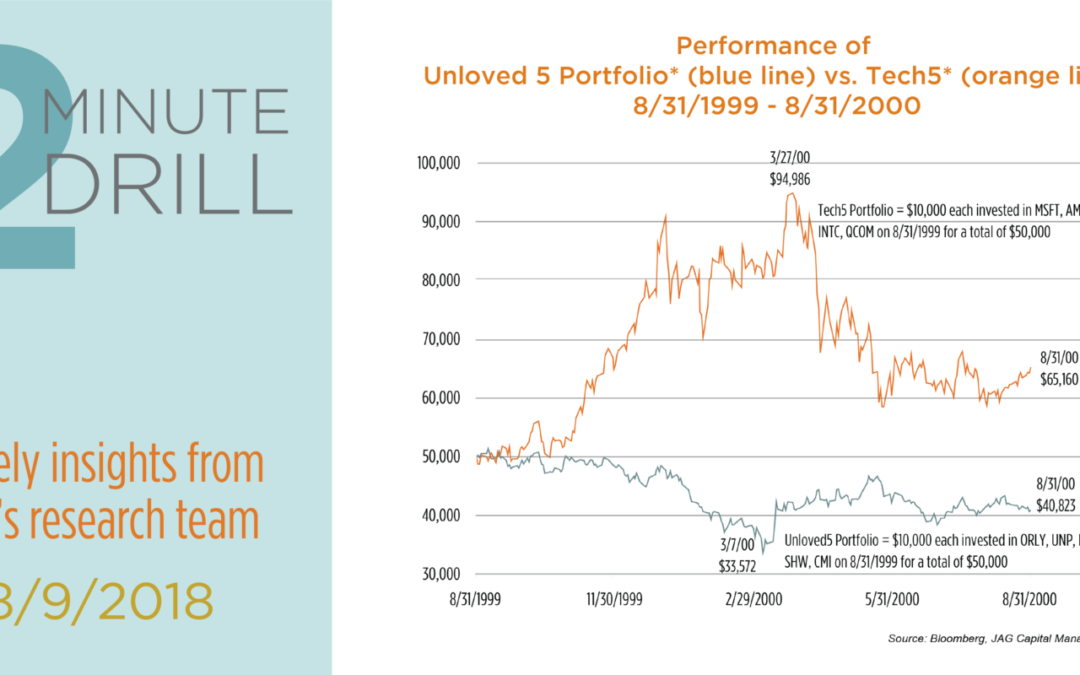

In the fall of 1999, if you were given the opportunity to own $10k each of the “Tech5” stocks or the “Unloved5” stocks, which would you have picked? Given that the Nasdaq had gone up ~500% from 1995 to this point, we think most would have felt pretty good about owning the Tech5 portfolio. Looking a year out, buying $50k of the Tech5 would have been the correct decision. Even with the painful correction from the end of March to August (down 31%) your Tech5 portfolio would have returned 30% vs. an 18% loss for the Unloved5 portfolio. So yes, the correction would have been extremely painful to hold through, but you would have come out with a 30% gain in 12 months. It’s always important to keep things in perspective.

Now consider the same question but starting where our last chart ends. Which group of stocks would you want to hold from 8/31/00 to today? As active growth managers, we would have assumed the Tech5 would be the place to go. We would have been dead wrong. From Aug. 2000 to now, the Unloved5 have compounded at 19.6% annualized return vs. 14.1% for the Tech5. Both portfolios should have made investors happy. A 14% annualized return for 18 years is enough to get any investor excited. Surely, investors would be disappointed they didn’t catch the 19% annualized put up by the Unloved5 but note that QQQ (Nasdaq 100 ETF) severely lagged both portfolios, with returns annualizing <4% a year. The ability to pick stocks vs. owning an ETF would been a massive advantage for investors over the last 18 years. So, while passive investment vehicles have gained traction (and assets) over time, most investors would have been disappointed with their returns if they had owned QQQ vs. an “active” portfolio. Things are not always what they seem. The ability to react to data and actively manage a portfolio still pays in our opinion.