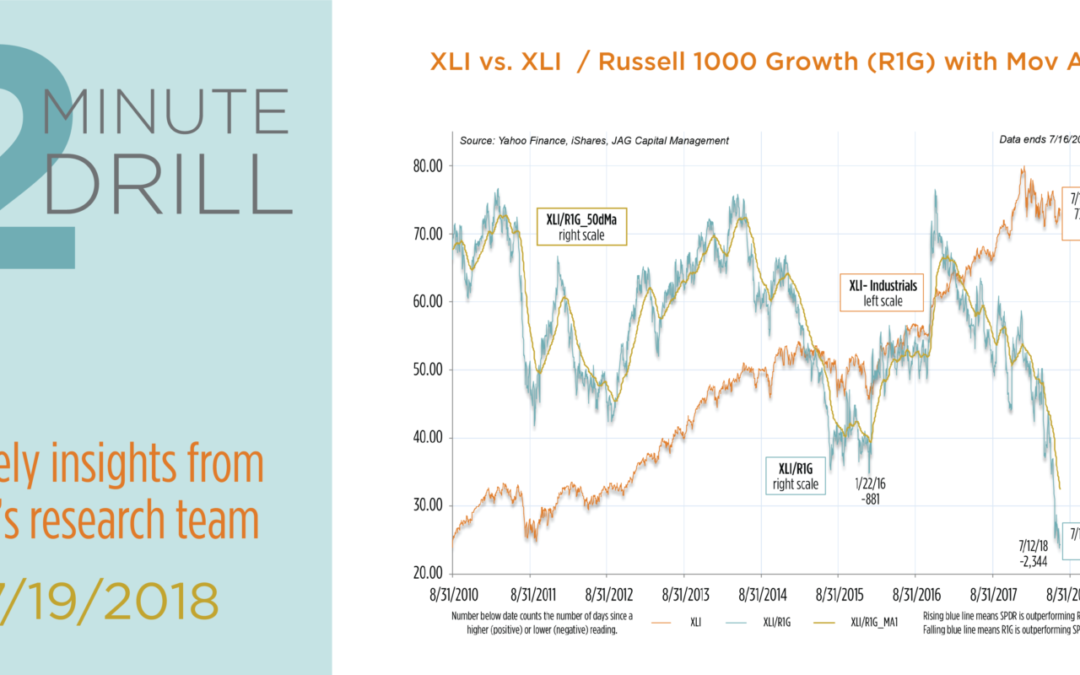

The Industrials sector has been lagging the Russell 1000 Growth Index badly so far in 2018. In fact, the Industrials Select Sector SPDR (XLI) recently made a 2,344 day low in relative strength, which equates to its worst relative performance in over 10 years. At first (and even second) glance, this makes little sense. After all, the economy is robust, corporate taxes are lower, and valuations appear relatively reasonable throughout many of the sector’s constituents. So what ails this cyclical, manufacturing-heavy group? We think investors are penalizing Industrials because they are facing an unappetizing “triple threat” of tariff threats, a strong dollar, and rising input costs.

Among the threats facing Industrials, tariffs are probably the biggest. If current confrontations between the US, the EU, and China bloom into a fullblown trade war, any manufacturers selling into global markets will face a headwind. On the other hand, any steps toward resolution would quickly be perceived as a tailwind for the sector. Thus far, there are signs that the EU is moving closer to President Trump’s demands for free(er) trade. China appears to be digging in their heels for the moment, but that could change over the next couple of months. The dollar and exchange rates are less of a problem for most large manufacturers, as they tend to have long experience managing currency fluctuations. Rising input costs, however, could continue to present a challenge. As this chart shows, common costs like Truck transportation are rising more rapidly than they have in years. When a company incurs higher costs to produce their goods or services, they must either (a) accept smaller profit margins and lower earnings; or (b) pass those higher costs onto their customers in the form of higher prices. Neither of these two choices are easy to navigate. Putting all the pieces together, Industrials are not currently an optimal fit with our growth-oriented investment approach.