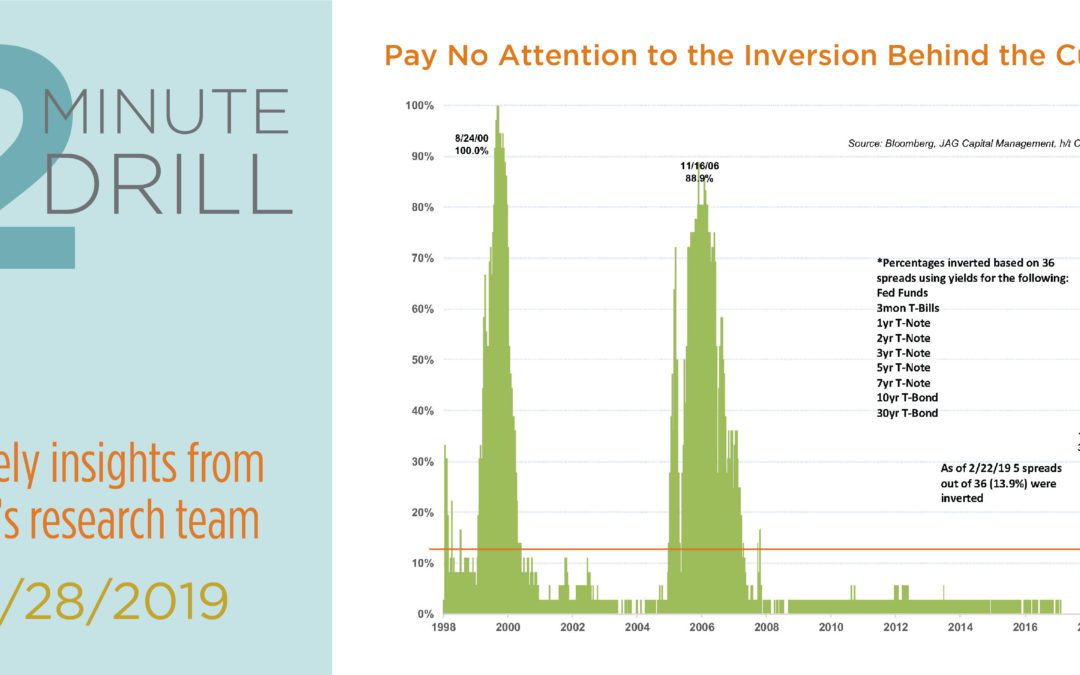

Traditional wisdom says that investors should head for the hills as soon as the yield curve inverts. As you can see above, of the 36 treasury yield spreads calculated, just 5 (or about 14% of the overall curve) are currently inverted. Despite this warning sign, investors continue to bid stocks up in 2019. In fact, the partial inversion is getting almost no attention from financial pundits on television or social media. We think there are 2 reasons that investors are largely ignoring the inversion. 1) The extent of the inversion isn’t enough to set off an alarm for most investors and they’re happy to let the market rebound from December 2018 lows. 2) It has become increasingly clear over the last decade (and especially since Jerome Powell has taken over) that the Fed will be flexible and accommodative when needed. We see no reason for that narrative to change based on recent market friendly actions by the Fed.

There also appears to be renewed confidence that the Fed will be able to orchestrate a “soft landing” given their increased policy flexibility. We think these factors help explain the market action we’ve seen so far in 2019. Investors are increasingly confident that 1) the Fed will navigate “normalization” successfully, 2) a trade deal will be made with China, 3) the global economy will continue to improve, etc. and shift to a more cyclical, risk-on trade. As a result, we’re seeing improving relative strength from Industrials and Energy sectors, as well as the Technology sector being led by more cyclical industries like semiconductors and semi equipment. On the other hand, you have deteriorating relative strength in traditional safe havens like Staples, Utilities, and Healthcare as investors increase their appetite for risk. We think that there are enough positive catalysts on the horizon that a pro-cyclical trade could continue through the rest of the year.