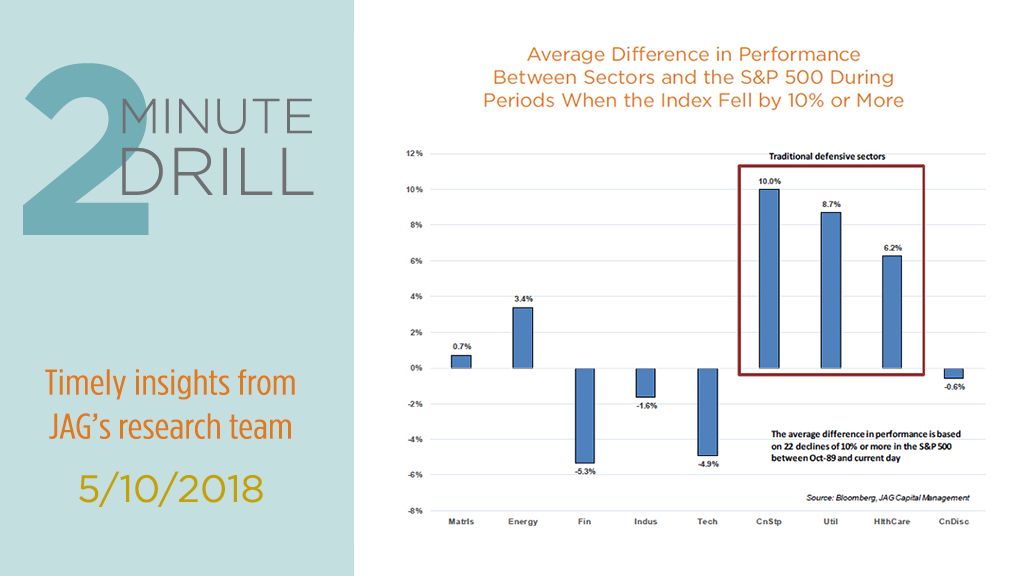

Where do stock investors tend to go when they feel the need to play defense? For the last three decades, Consumer Staples, Utilities and Health Care sectors have been relatively safe ports during market storms. All three groups have generated significant outperformance when the broader market has fallen by at least 10%. Of the three, only Utilities have followed the historical script during the most-recent correction. At least in terms of the so-called “risk off” trades, the market has largely flipped the script so far in 2018.

Although Health Care stocks have historically been resilient during market corrections, they have underperformed the S&P 500 by 3.2% since stocks peaked on 1/26/18. This has been the worst relative performance during a 10%+ correction since 1989. Investors who hoped that Health Care stocks would provide a buffer against market volatility have been sorely disappointed. We think the group is suffering from a growing realization that the U.S. health care regime is broken. While we do not claim to know the solution to this problem, it is easy to recognize that it simply costs too much to deliver quality health care services to American consumers. The path to fixing the system will probably involve scraping out a lot of costs (i.e. margins), which may be part of the reason that the group looks anything but “defensive” right now.

So far this year, Consumer Staples have been a bloodbath for investors. During the most recent correction, the sector has badly lagged the broader market. This has been unprecedented underperformance by a traditionally “blue chip” sector that has almost always exhibited reliably defensive characteristics. It seems “this time really is different” for the group. Although many Staples constituents have enjoyed decades of pricing power thanks to their ubiquitous household brands, the rise of dominant discount retailers like Amazon, Walmart, and Costco are crimping their ability to charge premium prices. At the same time, their input costs are rising, putting pressure on profit margins. And although many big-cap Consumer Staples companies pay attractive dividends, their yields are less attractive in a rising interest rate environment.

Almost no one has considered the Technology sector to be the least bit defensive over the past several decades. But this perception may deserve to change. Since the Great Recession, tech stocks have acquitted themselves relatively well during market corrections. Although the tech sector modestly underperformed during three of the last six 10%+ pullbacks for the S&P 500, they have materially outperformed in the other three, including in the most recent one. In our opinion, this makes sense. Several decades ago, the tech sector was much more hardware-centric, which made tech stocks more susceptible to cyclical swings in revenue, earnings and profit margins. Today’s technology sector is replete with Internet-enabled software companies, whose subscription-based revenue streams are smoother and more persistent.