March 8, 2022 —

Summary

We expect oil prices to remain high, based on recovering demand along with geopolitical tensions, with oil reserve releases likely to have only a temporary impact. Announced sanctions on Russia so far largely exclude the Energy sector, but banks globally are curbing lending for Russian commodity trading. While the US and Europe are currently discussing a potential ban of Russian oil imports, about two thirds of Russian oil is already struggling to find buyers.1 Europe will accelerate the transition away from Russian gas, but in the short-term, liquefied natural gas (LNG) shipments to Europe are unable to satisfy demand. We anticipate oil and oil producers’ stock prices to remain volatile for the next 6-12 months.

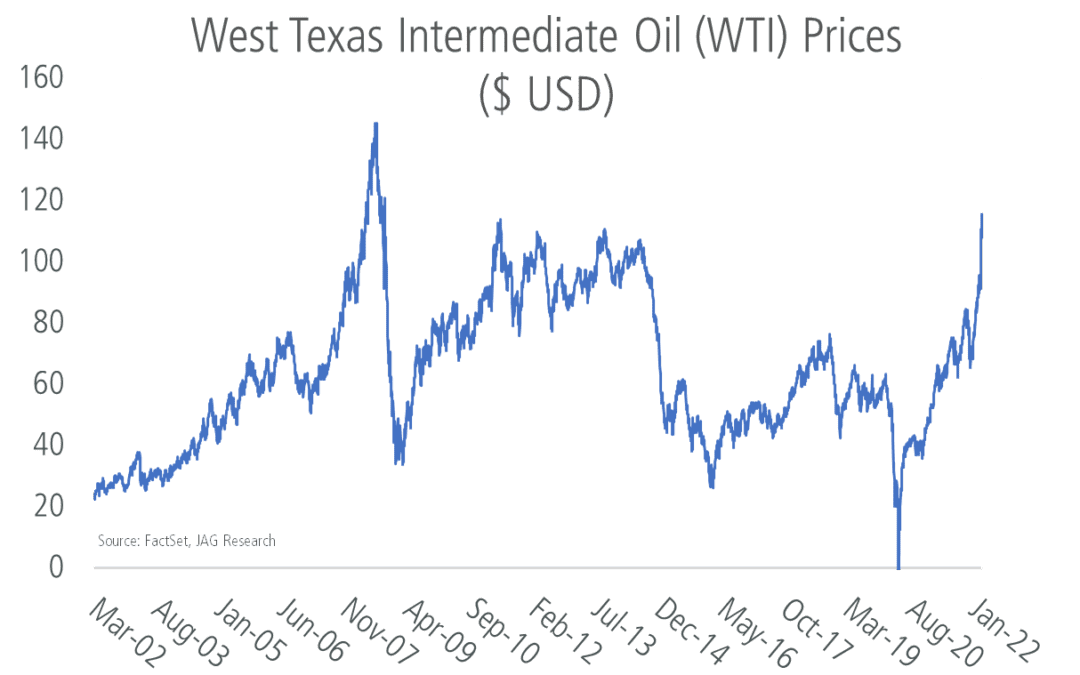

While the Russia-Ukraine conflict has recently led to increased oil price volatility, oil prices have been on a steady upswing since April 2020 following the early COVID-19-related demand destruction and a short-lived Saudi-Russia oil price war.

The reason is twofold. First, oil demand has been recovering since the initial shock as more countries ease lockdowns and travel restrictions. Second, the initial weaker oil demand and pricing have led to a material drop in oil and gas capital spending, reducing oil production capacity. On top of this, OPEC (Organization of the Petroleum Exporting Countries) in conjunction with Russia has implemented voluntary supply cuts to support oil markets. OPEC has been ramping production up only gradually, with some countries failing to meet production quotas due to infrastructural and political challenges (e.g., civil unrest in Libya).

Historically, higher oil prices have incentivized more oil production, which in turn usually brings oil prices back down. This is particularly true for the US onshore producers (also often referred to as “Frackers”), who can bring new production online in just several months versus more long-cycle offshore projects. However, while oil production in the US has been recovering (Figure 2), the recovery is generally weaker than many anticipated. The primary reason for a relatively muted production recovery is producers’ focus on capital discipline. Though increased oil production has made the US less dependent on foreign oil markets, undisciplined investments into production growth have severely damaged US oil producers’ balance sheets and weighed on oil prices — with Energy materially underperforming every sector during 2010-2020 according to FactSet. As a result, oil producers are currently prioritizing debt reduction and shareholder returns (buybacks + dividends) over production growth to appeal to investors. This also explains why the vast majority of recent rig count additions in the US have come from small private operators — the ones that do not have similar shareholder pressure. In addition to capital discipline, oil production growth has also been weighed down by less favorable regulatory policies tied to environmental concerns, and reduced debt financing availability as banks aim to reduce risk amid the previous volatile and low oil pricing environment.

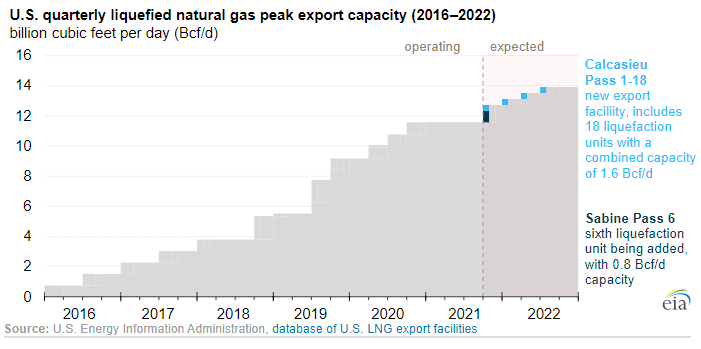

Natural gas prices have also risen dramatically, particularly in Europe, on the back of recovering demand, limited supplies, and seasonally low inventories. LNG remains the fastest growing part of the fossil fuel industry and in light of heightened tensions with Russia, there is increased talk of potentially replacing Russian gas exports to Europe with LNG shipments. US LNG exports have been quickly rising (Figure 3) and the US is projected to have the world’s largest LNG export capacity by the end of 2022, with a peak capacity of 13.9 billion cubic feet per day (Bcf/d). However, US LNG volumes alone will not be nearly enough to replace Russian imports. For comparison, according to British Petroleum, the European Union consumed 36.66 Bcf/d of natural gas in 2020, with Germany alone consuming 8.35 Bcf/d.

Other countries such as Qatar could also provide more LNG to Europe, but it’s worth noting that LNG contracts are generally long term (15-20 years), and redirecting supplies is often not a viable option. Finally, infrastructure remains a bottleneck. For example, Germany currently does not have any LNG import terminals and just announced it will accelerate the development of two terminals. These factors in large part explain why the current sanctions on the Russian economy avoid the Energy sector.

JAG’s investment approach helps us identify great companies that can capitalize on durable sector and industry-specific trends and opportunities. We welcome your comments and questions any time!

– George Margvelashvili, CFA®, JAG Investment Team

1 J.P. Morgan, Oil Weekly, March 3, 2022