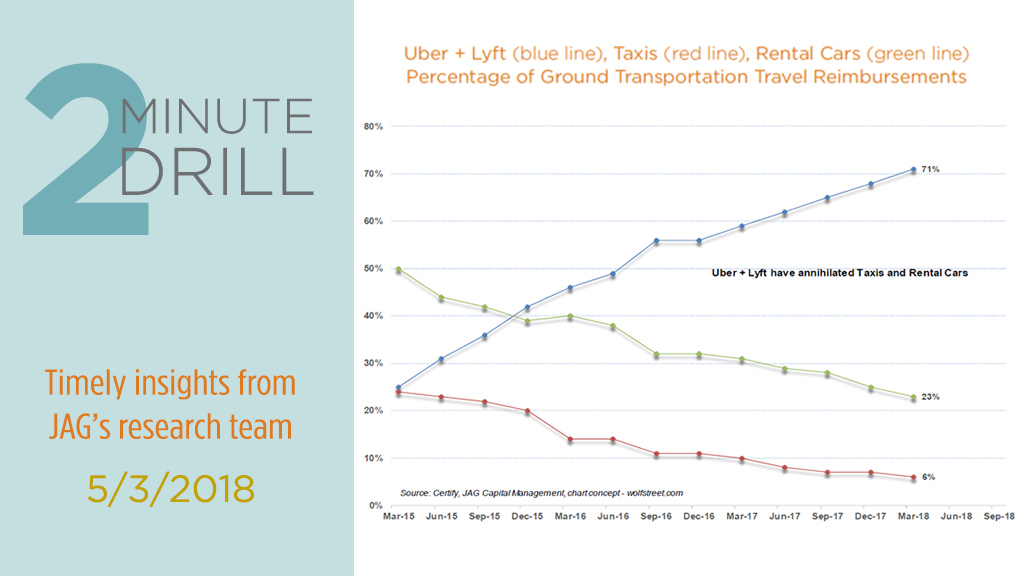

Rarely have we come upon such a simple, stark picture of rapid technological disruption as we find displayed in this chart. As recently as early 2015, taxi and rental car receipts represented a combined 75% of all corporate ground transportation travel reimbursements in the U.S. By late 2016, Uber and Lyft reimbursements had grown to more than 50% of the total. Less than two years hence, the market share of taxi and rental car receipts have collapsed to less than 30%, while Uber and Lyft’s combined shares have exploded to 71%. Although neither Uber or Lyft are public companies (yet), we think there are still some important takeaways for investors. First, given that the shares of both Hertz and Avis-Budget have vastly lagged the broader equity market over the past three years, investors should be careful when evaluating apparently “cheap” stocks that operate threatened business models. Secondly- and more broadly – we think technological disruption is arguably occurring faster today than at any time in the past. If we are correct in this opinion, it is likely that investors should expect more incumbent business models to be quickly cast aside by technological advances in the future. This will create both phenomenal opportunities and risks for long-term investors. Stated another way, true disruptors could experience outsized gains, while “disruptees” could experience rapid and dramatic valuation declines.

P.S. According the Wall Street Journal, the auction prices of New York City taxi medallions fell below $200,000 apiece in early 2018, less than five years after peaking at roughly $1 million.