Investment performance is often measured in convenient slices of time. For example, most experienced investors are familiar with mutual fund advertisements detailing a fund’s trailing 1-,3-, 5-, and 10-year performance. Of those periods, the last one – the immediate past decade of average annualized returns – tends to carry a lot of psychic weight for investors. This makes some sense. Although ten years is infinitesimal in the grand scheme of history, in stark actuarial terms it represents a good chunk of the total amount of time we can hope to spend on this mortal coil. Even for Warren Buffett, who has been investing since he was a teenager and is now 88 years old, ten years represents more than 15% of his entire body of work as an investor. For most of the rest of us, who started saving and investing later than Mr. Buffett, and who may not be blessed with his Methuselah-like lifespan, 10 years probably amounts to as much as 25% of the total amount of time most of us have available to invest and accumulate wealth. Nothing to sneeze at!

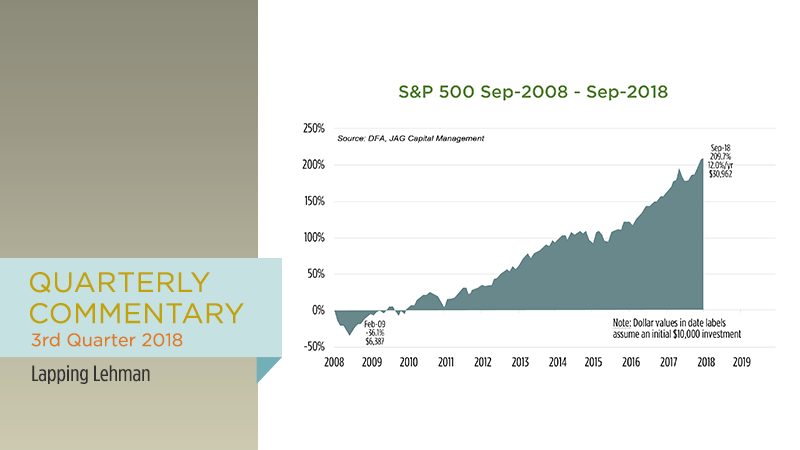

With that in mind, we note that the calendar is (finally) beginning to “lap” the Great Financial Crisis of 2008-2009. By this we mean that it has now been more than ten years since Lehman Brothers spectacularly failed on September 15, 2008, which kicked off the climactic phase of the worst economic and market event since the Great Depression in the 1930’s. Post-Lehman, the S&P 500 gyrated through another six months of gut-wrenching volatility before finally bottoming for good in March 2009.

Therefore, by March 2019, the worst parts of the Crisis will have receded more than ten years into the past. These are welcome anniversaries for investors and investment managers. They also provide us with an opportunity to re-emphasize the importance of a truly long-term approach to investing.

We need to highlight and appreciate the fact that the post-Crisis era has been a great time to be stock investor. For the past ten years through 9/30/18, the S&P 500 Index has delivered average annual returns of almost 12%. It is also worth noting that as good as it has been, this last decade ranks only in the 59th percentile of all rolling 10-year periods for the S&P 500 since 1926. There have definitely been bigger bull markets in the past, including in the 1950’s and 1990’s.