One of the most frustrating but central tenets of investing is that successfully predicting the short-term future path of the stock market (i.e. market timing) is essentially impossible. Indeed, to paraphrase Ken Fisher, price movements seem almost predestined to embarrass and confuse as many people as possible. This year’s particularly confounding stock market action is an excellent case in point. After posting its worst-ever start to a calendar year (which smacked investors with an 11% decline between New Year’s Eve and February 11), optimism was in short supply. Full valuations, cratering commodity prices, slow economic growth, and disappointing earnings results were all cited as reasons to be cautious. Add to those factors the surprise UK “Brexit” vote in late June, a truly bizarre U.S. presidential election campaign, ISIS-inspired lone-wolf terror attacks, and the continuous stream of point/counterpoint from the Fed on the prospect for higher interest rates, and one would be forgiven for being fearful of a big pullback in stock prices. Not so fast! In a surprising (humiliating?) turn, the S&P 500 rallied almost 20% from the February lows, leaving the benchmark index with a year-to-date total return of almost 8% at the end of the third quarter.

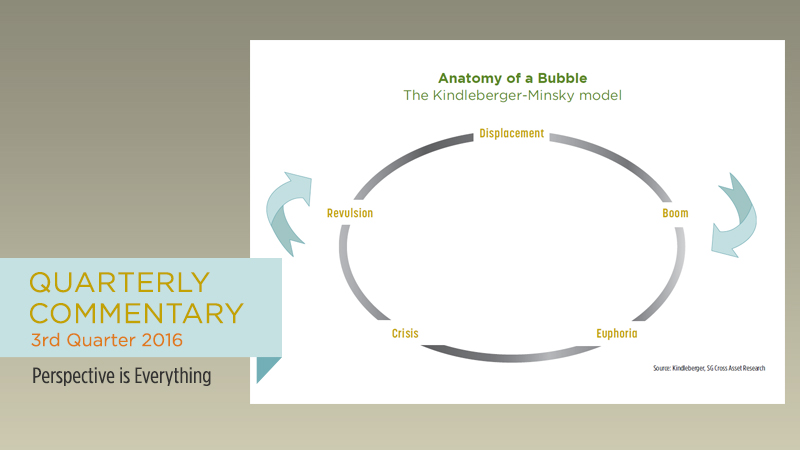

By their very nature, surprising events can have a tendency to induce fear. We think Mr. Trump spoke for many when he declared the stock market to be in a “bubble.” From our perspective, this has been a truly hated bull market for years now. There is a widely-held belief that the Fed is propping up the stock market, and that the big gains we have seen since 2009 are somehow artificial. Slower-than-normal economic growth and disruption in the labor market is seen as evidence that the stock market has become unmoored from the “real economy.” Trump knows this line of thinking has lots of adherents in the American electorate, and our sense is he knew that this comment would gain him some traction with voters who may be feeling economically disenfranchised. But is he right?

We think not. Trump’s comment on the stock market reminded us of a famous exchange from a 1988 vice presidential debate, when Dan Quayle attempted to counter the perception that he was too inexperienced for the job (he was 41 years old at the time). Quayle noted that he had more experience in Congress than John F. Kennedy had at the time he ran for President. Lloyd Bentsen famously replied, “Senator, I served with Jack Kennedy. I knew Jack Kennedy… Senator, you’re no Jack Kennedy.”

For our part, had we been able to respond to Trump’s comment at the debate, we would have said something like, “Sir, we have lived through bubbles (the tech, commodity, and housing bubbles have all blown up and popped within the last 20 years). We know bubbles… Sir, this is no bubble.”