What the heck is going on with inflation? In the 1970’s and 1980’s, rampantly rising prices were the bane of our economy (the cartoon to the right was published in 1974). But today, despite years of intensive stimulus from central bankers around the world, inflation is nowhere in sight. For those who follow economic and market history, this is a strange development.

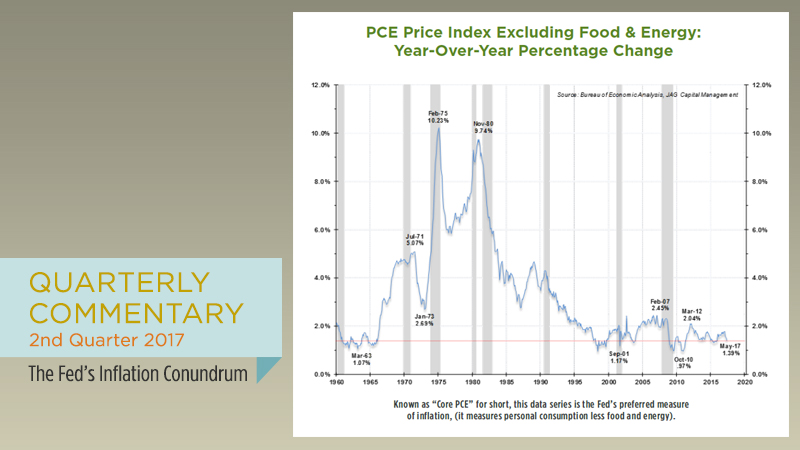

Generally speaking, when central bankers perceive that their economies are growing too slowly, they provide monetary stimulus by lowering overnight interest rates. Lower rates encourage households and businesses to borrow and spend more money. Eventually, the volume of stuff that consumers and corporations want to buy begins to outstrip the ability of the economy’s capacity to produce goods and services. This causes wages and prices to rise, which generates inflation. In the aftermath of the 2008-2009 financial crisis, central banks around the world lowered rates to zero in an attempt to stabilize the financial system and boost economic activity. And yet – after nine years of “easy” monetary policy – inflation remains well below the Fed’s 2% target.

The absence of inflation has perplexed some of the smartest economic minds in the world, including Federal Reserve Bank of Chicago President Charles Evans, a PhD economist who has taught at several elite universities. As quoted in a July 9, 2017 article in the Wall Street Journal (Central Banks Looking to Reduce Stimulus Face Quandary of Falling Inflation), Evans said, “I sometimes wonder if there isn’t something more global, more technological that’s taking place that we don’t quite have our arms around very well.” In a June 20, 2017 interview with CNBC, he stated: “In a world of global competition and new technology, I think competition is coming from new places. New partners are choosing to merge and sort of changing the marketplace and [bringing] more competitive pressures on price margins.”