Growth Equity

Large Cap Growth

Actively managed equity strategy.

Growth Equity

Large Cap Growth Equity Strategy

Best Ideas portfolio with large cap growth style consistency.

- High active share versus the Russell 1000 Growth Index

- Focused portfolio of around 30-40 publicly traded high-quality stocks

- A disciplined, repeatable process for stock selection

- Proactive sell-discipline

- Research-driven, contrarian insights lead to differentiated opportunities within prudent risk/reward parameters

JAG’s experienced, entrepreneurial portfolio management team seeks to add value by curating a portfolio of companies that exhibit superior growth characteristics, solid fundamentals, and compelling price appreciation potential.

Discover The Latest Insights

Stay up-to-date with reports and insights from our analysts and practice leaders.

JAG Growth Equity Thematic Insights: Q4 2025

December 2025 Investing in Transformation That Matters Need For Speed: Silicon Edition The AI landscape continues to evolve rapidly, with recent headlines...

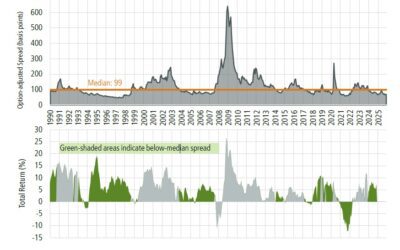

JAG Fixed Income Thematic Insights: Q4 2025

December 2025 - Spread Thin? Why Credit Still Deserves a Place in Portfolios Summary In last quarter's Insight, we examined the relationship between yield...

3rd Quarter 2025: Markets, Machines, and Megawatts

Markets, Machines, and Megawatts Markets entered the third quarter with strong momentum from the spring rebound and never looked back. The S&P 500 climbed...

Strive For More with Large Cap Growth

View the Quarterly Fact Sheet for detailed information.