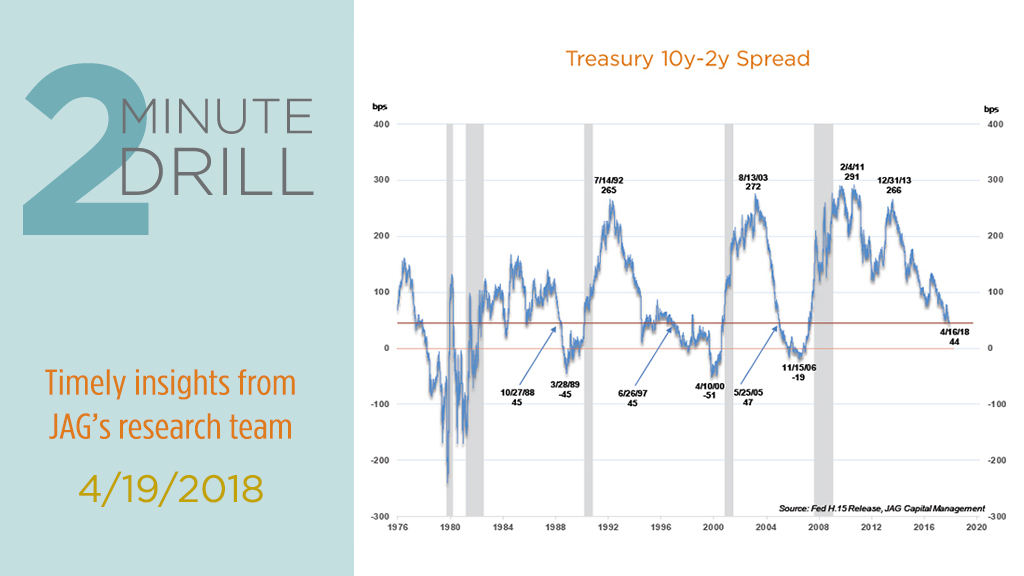

The closely-watched 10yr/2yr Treasury yield curve continues to flatten, which is causing no shortage of hand-wringing. At the risk of oversimplifying what is happening, curve flattening is a function of short term rates rising faster than long term rates. The stock market generally reacts favorably during periods when the yield curve is flattening. But there can be “too much of a good thing.” If the yield curve continues to flatten, it will eventually invert, which describes an environment in which short-term interest rates are higher than longer-term rates. Investors worry that inverted yield curves generally precede recessions (denoted by shaded areas on the chart). We have no special insight into the short-term direction of interest rates, but we would note that it is far from a certainty that the yield curve will invert. And even if it does, recessions typically occur many months after the initial point of inversion. Therefore, the flattening curve ranks low on a list of data points that would tilt us bearish.

Economic fears often manifest themselves in widening credit spreads before they show up in the stock market. Note that despite the recent volatility in stocks, credit spreads continue to tighten. We regularly monitor the ratio of CCC-rated to AAA-rated bond yields, as depicted in this graph. As illustrated, this ratio has recently compressed to pre-2008 levels, which implies that the credit market continues to be sanguine – even regarding the prospects for deeply junk-rated bonds. While we are not fans of the current risk/reward profile of CCC bonds, we view stable credit market conditions as bullish for risk assets. It is highly likely that the next recession will be flagged by a material increase in the CCC/AAA yield ratio. We will continue to watch this indicator closely, but right now the credit market “watchdog” is quiet.