What companies and sectors stand to benefit most from tax reform?

Holy tax reform, Batman! This chart plots the relative performance between stocks of companies with high tax rates and those with low tax rates. When the blue line is moving down, low tax rate companies are outperforming. When the blue line heads north, more highly-taxed companies are leading. Low tax rate stocks have led the charge since early 2015, but leadership has recently changed in a big way. The big vertical spike in the lower right-hand part of the chart coincides with the Senate successfully passing their version of the tax reform bill, which greatly increases the likelihood that corporate tax cuts will be signed into law. That said, the spiky, almost panicked rush into high tax rate stocks gives us pause. Many of the best-performing individual stocks of the last few weeks have been bouncing up sharply from long-term lows, and a significant proportion of these “big bouncers” have deeply challenged business models.

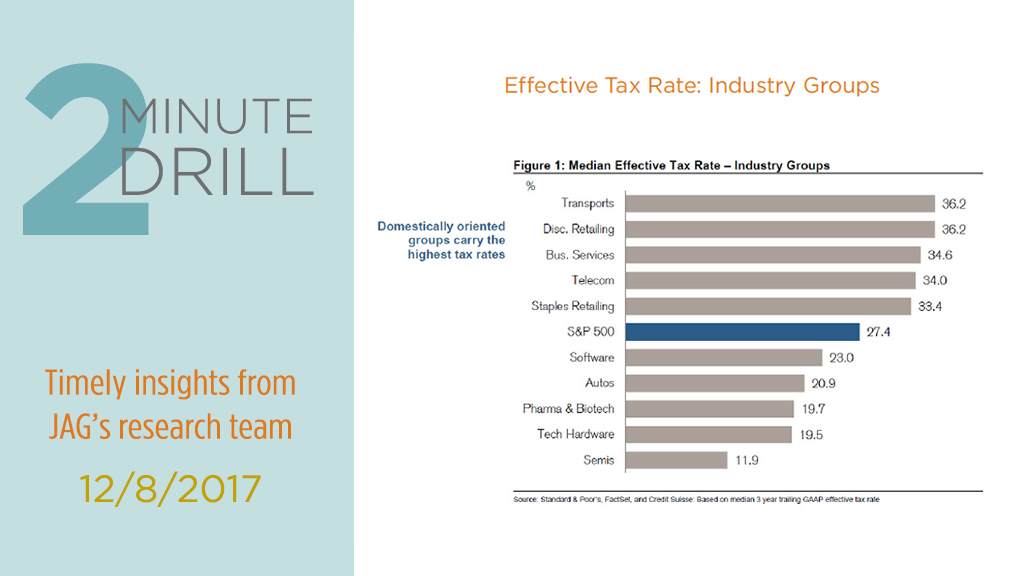

Close market observers know that the transports, retailers, and telecom stocks have done quite well over the past few weeks. As this graph from Credit Suisse shows, these industries have the highest effective tax rates, which implies that they have the most to gain from corporate tax cuts. These companies also tend to generate most of their sales domestically rather than overseas. At the other end of the spectrum, the semiconductor industry group sports a low effective tax rate of 11.9%. Moreover, most of the larger companies in this group derive a significant percentage of their revenues from international sources. Is it any wonder that semiconductor stocks have taken it on the chin lately?

This graph allows us to compare the effective tax rates of the constituents of the Sector SPDR ETF’s. The Industrials (XLI), Energy (XLE), Utilities (XLU), Financials (XLF), and Consumer Staples (XLP) all have higher average effective tax rates than the S&P 500. At the margin, companies in these ETF groupings would experience more of a benefit from lower corporate tax rates. On the other hand, Materials (XLB), Healthcare (XLV), and Information Technology (XLK) have lower effective rates than the broader market. All else being equal, these latter groups stand to benefit less from tax reform.

Courtesy of Goldman Sachs, the three best-performing stock baskets since 11/24/17 have been the Domestic Cyclicals, (High) U.S. Sales, and High Tax Rate groupings. The lagging groups have been (High) International Sales, (High) Revenue Growth, and (High) Capex and R&D. This furthers the points we have been making about the tax reform rally, in that the primary beneficiaries have been domestically-oriented companies with high effective tax rates. While we respect the power of the recent rotation, we question whether the relatively small tailwind from lower corporate taxes will allow the highlighted best-performing baskets to sustain this level of outperformance into 2018.