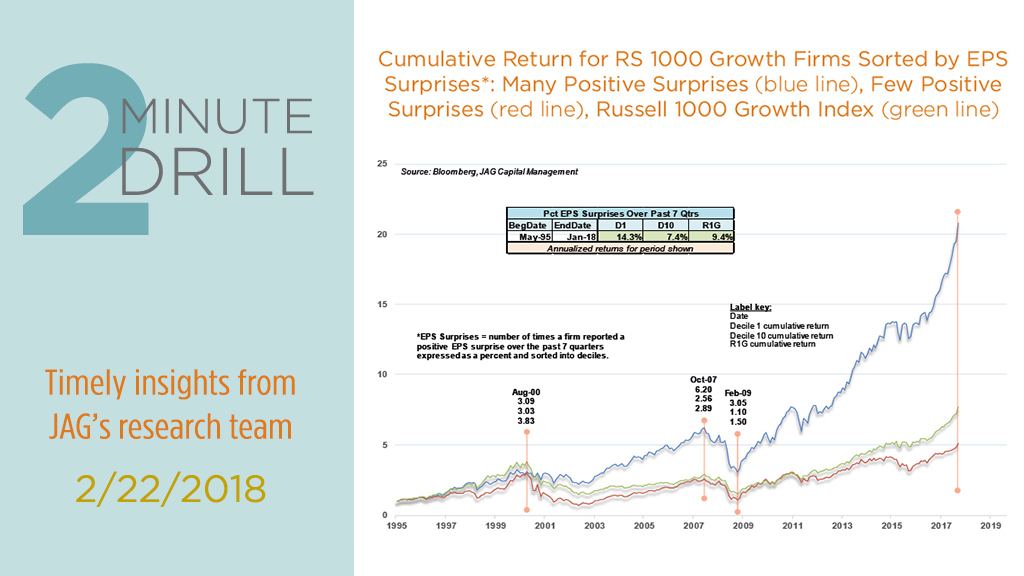

As growth stock managers, we believe that “price follows earnings” over the long run. That is, stocks that demonstrate superior earnings growth can be more likely to outperform the broader markets. One way to identify these types of earnings winners is to focus on companies which frequently produce positive earnings surprises. These types of companies often have developed particularly attractive products or services that are in heavy demand within their served markets. In the best cases, they can generate years of outsized top and bottom line growth, healthy and expanding margins, and significant alpha for investors. Here we show that firms generating the most positive earnings surprises have vastly outperformed those with the fewest positive surprises since 1995.

Of course, stocks with the highest frequency of earnings surprises do not outperform in all types of market environments. In fact, as shown in the table inside the chart, companies with the most positive earnings surprises have had several rough periods, including during the late 1990’s, the lead-up to the Financial Crisis, and Eurozone turbulence in 2011-2012. But this elite cohort’s significant outperformance following the bursting of the Tech bubble and in the aftermath of the 2008 crisis make up the bulk of its cumulative alpha since 1995.

Here we see that the top 3 deciles (i.e. top 30%) of firms with the highest frequency of earnings surprises have produced significantly positive annualized active returns since 1995. By way of contrast, the bottom two deciles have produced negative active returns over the same timeframe. Thinking beyond the data, our observation is that companies which consistently fail to deliver upside earnings surprises are probably more likely to be experiencing headwinds in their served markets, margin compression, and/or deteriorating top-line growth. As growth equity managers, we generally take a pass on those types of situations.