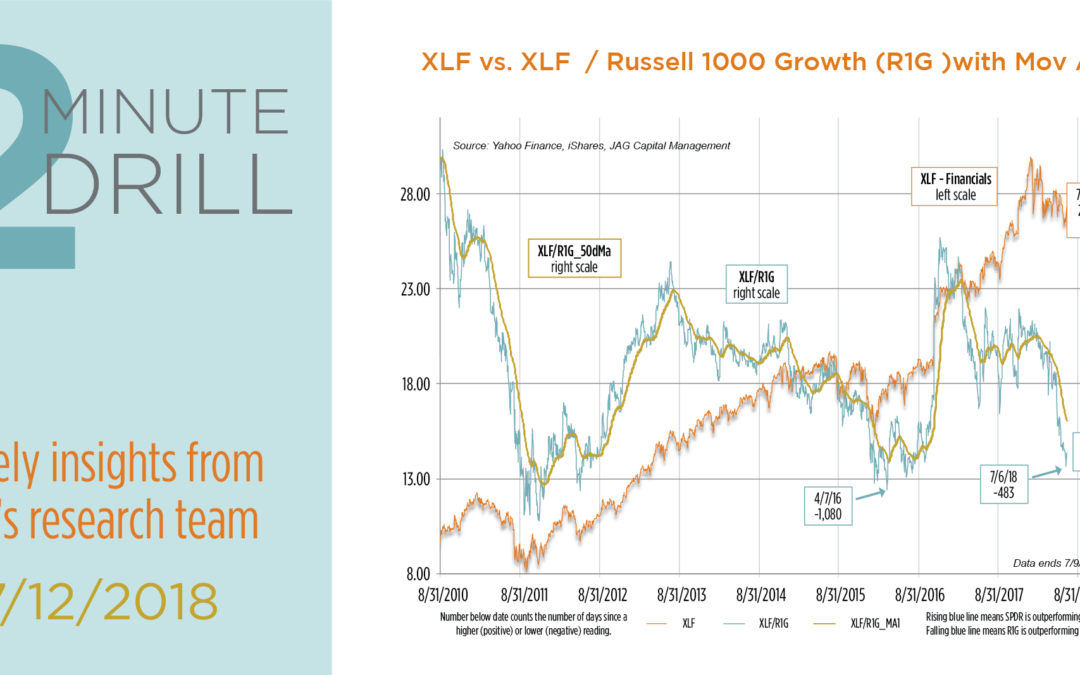

We have been favorably disposed to stocks in the Financial sector since last year, but relative strength has recently deteriorated. Note that the Financials Sector SPDR (XLF) recently hit a 483-day relative strength low and appears to be near the important support level that was set in April 2016. Much of this is driven by widespread underperformance in big cap banks. Although higher interest rates and a strong economy are generally tailwinds for banks, investors are concerned that the flattening yield curve could compress net interest margins. There are also lingering worries that some EU banking institutions are showing signs of distress, which could spill over to the biggest US-based banks. There are a variety of bullish counter-arguments, including attractive domestic bank valuations, increasing returns of capital to shareholders, and favorable lending growth trends.

Using a concept put forth by Bespoke, we ran a multiple regression using investment-grade bond spreads and 2-year Treasury yields as independent variables. That is a mouthful, but it allows us to compare the S&P 500 Bank Index to its predicted value. By this measure, bank stocks appear to be just about as inexpensive as they have been in the last five years. If history is any guide, the Financials could be at or near an attractive level for investors. We will be watching closely and acting accordingly!