The bulls continued to run on Wall Street last quarter, pleasantly surprising many individual and professional investors. The S&P 500 Index gained over 4% for the three months ending September 30, 2017, bringing its year-to-date total return to 14.24% (including dividends). The benchmark index has now returned more than 278% since March 2009, which works out to an average annual return of almost 17%, since stocks put in a generational bottom during the Great Financial Crisis of 2008-2009. Those who maintained a steady hand during the last big bear market have been handsomely rewarded.

We have no special insight into what the equity market will do in the coming few months. Thankfully, neither does anyone else. We all look through a glass darkly when it comes to the future. That said, there are several arguments in favor of continued gains. The global economy is perking along nicely, inflation and interest rates remain low, and corporate earnings are generally healthy. We are not yet sure what the final version of tax reform will look like, but both parties seem to show interest in lowering corporate taxes and reducing the number of individual tax brackets and deductions. Our educated guess is that a bipartisan tax package of some sort will come to fruition by early 2018. These positive factors may not yet be fully “priced in” by stocks, which could leave room for a year-end rally.

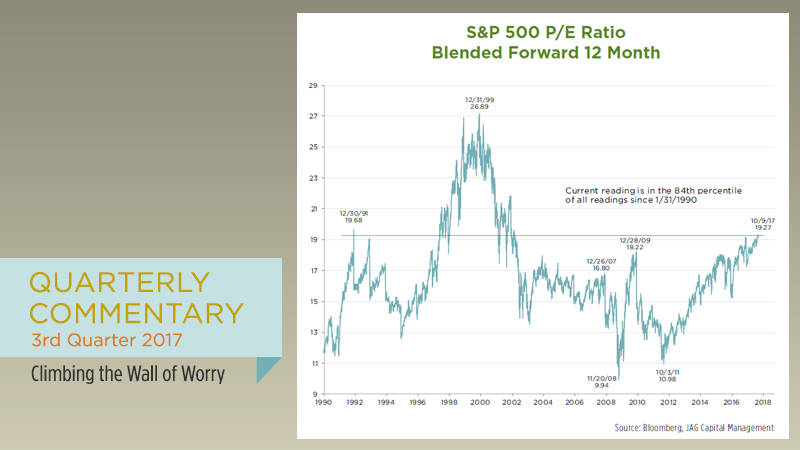

On the other side of the coin, bears can point to elevated valuations, widespread investor complacency, and geopolitical concerns as reasons for caution. At 19.3x forward earnings, the S&P 500’s valuation is more expensive than it has been since 2001 and is in the highest 16% of all such values recorded since 1990. To continue to leap higher, stocks could get still more expensive (as they did between 1996 and early 2000), earnings could grow faster than expected, or some combination of both. But it is no longer fair to say that stocks are “cheap” by this or most other measures. Investors may also be getting a little too comfortable with the false notion that stocks only go up. Dating back to the first quarter of 2013, the S&P 500 has delivered gains in 18 of the last 19 quarters, a streak that has never occurred before since at least 1930. Markets have been so kind, for so long, that some investors may be forgetting how painful corrections can be. The political backdrop is a wildcard. Love him or hate him, President Trump is a unique politician in American history. His off-the-cuff comments, impulsive leadership style, and proclivity to be a gadfly could result in unexpected consequences domestically or with international relations.