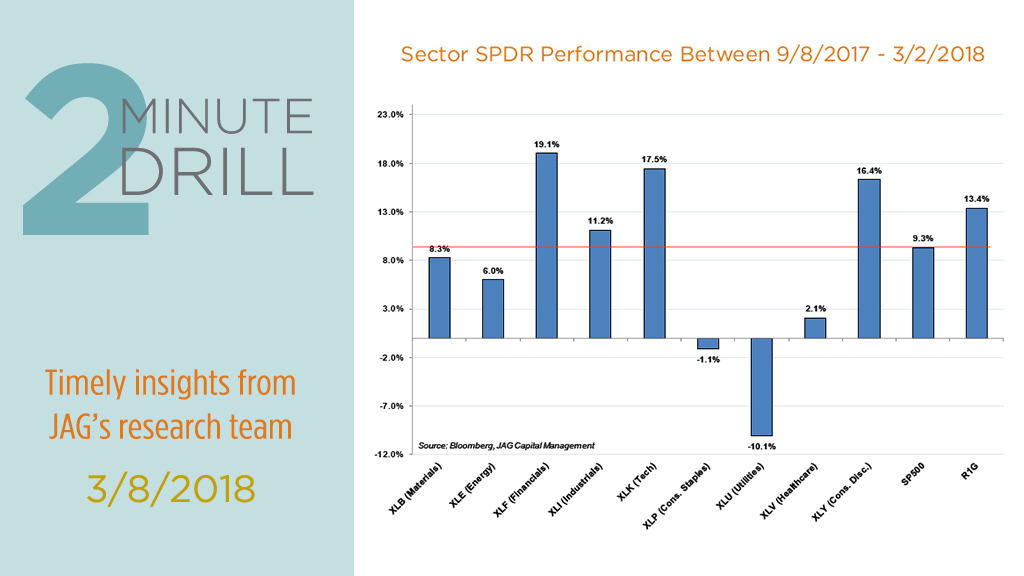

For most of the post-crisis bull market, many pundits have claimed that “easy money” was the primary factor driving stock prices. But since former Fed Chair Janet Yellen announced the transition from QE (easing) to QT (tightening) in early September of last year, stocks have continued to ramp. Indeed, the S&P 500 has returned more than 9% and the Russell 1000 Growth has gained over 13%. The best-performing sectors have been Financials, Technology, and Consumer Discretionary. Meanwhile, Utilities and Consumer Staples – both traditionally sources of reliable dividend income – have produced losses over the same timeframe. We think sticking with the leaders makes sense here, and we favor stocks with high top- and bottom-line growth, pricing power, and favorable product/service cycles. Accordingly, Tech and Financials are our two favorite groups.

The February 2018 Non-Manufacturing ISM (NMI) report came in at 59.5, representing the 97th consecutive month of expansion for the critically-important service sector of the U.S. economy. The New Orders component of the index hit 64.8, a month-over-month increase of 2.1 and the highest such figure since August 2005. This report, combined with ISM’s strong 60.8 reading Manufacturing (PMI) report for February, paints a picture of an economy that continues to grow smartly. While the stock market and the economy rarely move in lockstep, it is worth noting that these sorts of strong ISM data points make it highly unlikely that we face a recession within the next 12-18 months.