May 24, 2022 —

Summary

- A confluence of factors including the recovery of demand, capacity reductions, lower China exports, and geopolitical tensions are driving record-high gasoline and diesel prices.

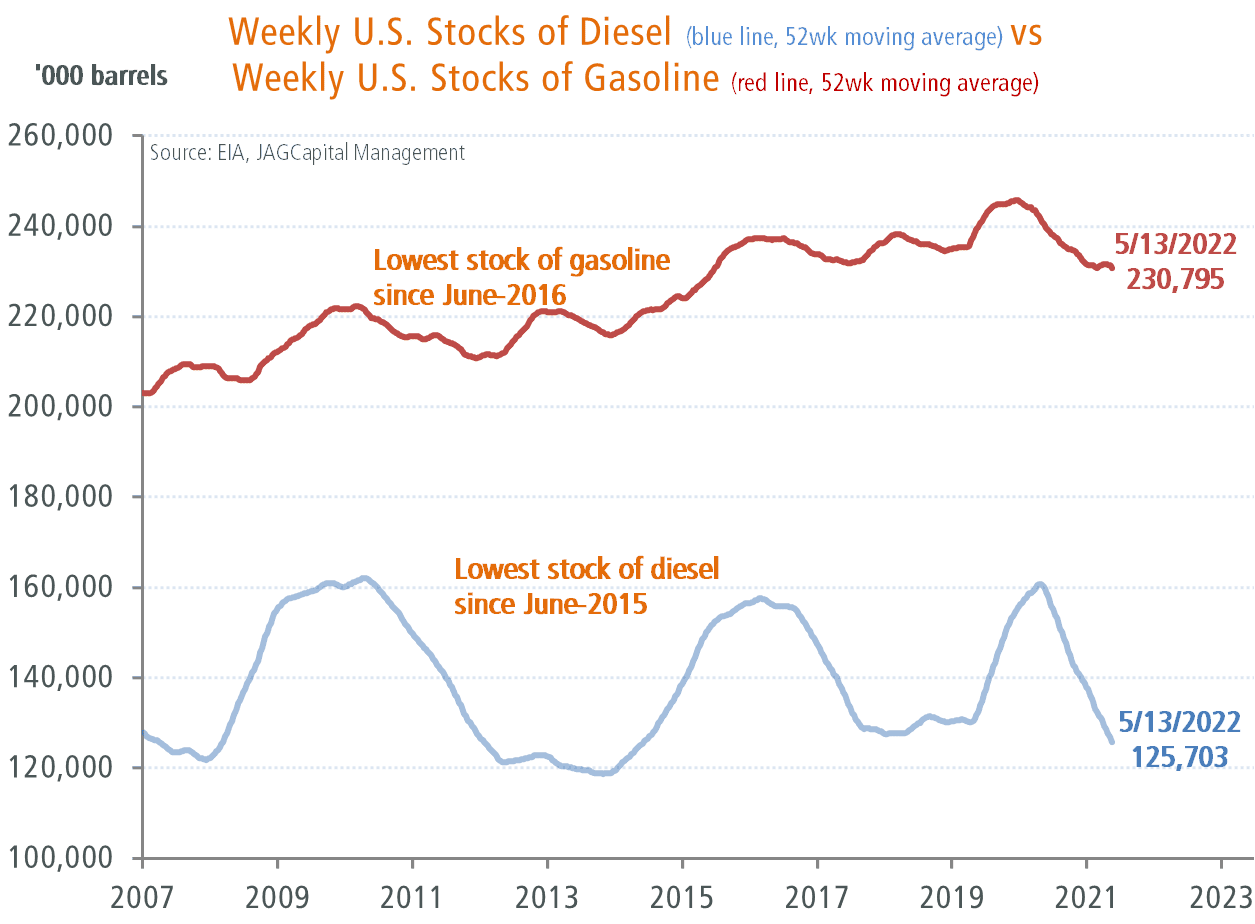

- Clean petroleum product (such as gasoline, diesel, jet fuel) inventories remain low globally, with some countries already experiencing product shortages.

- While supply shortage risks also exist in the US with inventories particularly low on the East Coast, we believe it is highly unlikely the US “runs out of fuel.”

- High inflation rates remain a prime focus for central bankers and investors. Although it is likely that overall inflation rates will moderate in the coming months, we do not believe prices at the pump will fall meaningfully over the near term.

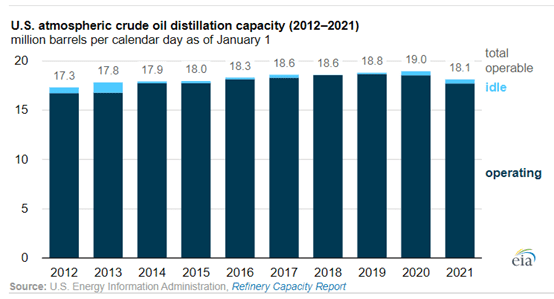

US consumers continue to contend with high prices at the pump, with the national average now over $4.5 per gallon. There are multiple reasons for the recent spike in gasoline and diesel prices. First, demand has recovered more quickly than anticipated. Second, the initial COVID-related demand destruction weakened refining margins (the difference between refined product prices and the cost of crude oil) and led to refinery closures, with the US capacity cut by ~1 million barrels per day (mmbpd) in 2021. In addition, like crude oil, the refined products market is also global in nature, and developments overseas have a material impact on domestic supply-demand conditions. China has been cracking down on small independent refiners (also known as “teapots”) to meet emission reduction targets and has materially reduced export quotas, with China diesel exports falling as much as 80% year-over-year in April. Covid lockdowns in China have also contributed to this decline. Finally, the Russia-Ukraine war has disrupted refined product shipments to Europe, further driving prices higher.

Low petroleum product inventories are causing refined product shortages worldwide. For example, last week the Sri-Lankan government said they only have one day of petroleum inventory left as the country is facing a deep economic crisis. While regional shortages are likely to continue, the US is in the best position to withstand the challenged supply environment. Even considering diesel, the petroleum product most at risk in the US with inventories at record lows (Figure 2), there is enough capacity to increase supply. The US is a net exporter of ~1 mmbpd of diesel and could cut exports if the shortage becomes more acute at home. In addition, while US refiners are already operating at ~90% capacity utilization, the emergence from this spring’s refinery maintenance season should add to worldwide refining capacity. The shortage could also ease if demand falls off as the US economy slows, but in the next three to four months, the summer travel season is likely to increase demand, supporting high prices.

Although we view it as likely that the year-over-year and month-over-month rates of inflation are likely to ease a bit over the next several months, we think gas prices will remain frustratingly high.

Figure 2: US Refining Capacity

JAG’s investment approach helps us identify great companies that can capitalize on durable sector and industry-specific trends and opportunities. We welcome your comments and questions any time!

– George Margvelashvili, CFA®, JAG Investment Team