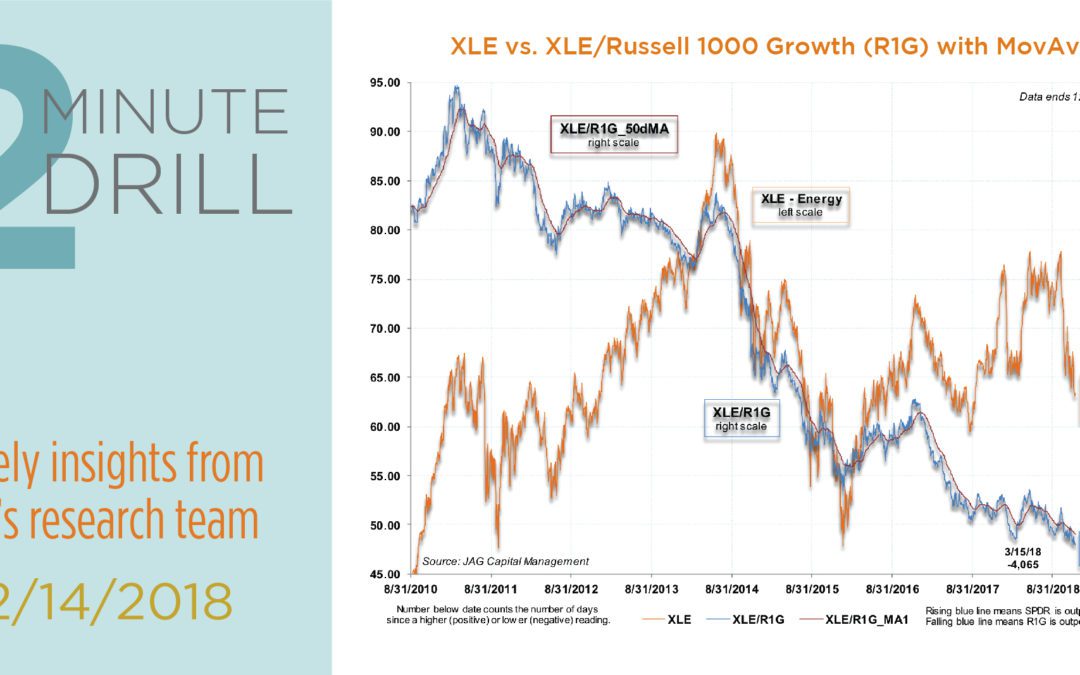

On the supply side, the world is awash in oil. Largely due to the explosion of US shale oil production over the past decade, the US is now the world’s swing producer. This has (probably permanently) undermined the power of OPEC to influence oil production and pricing. Global demand for oil also seems to be plateauing, due to the better vehicle fuel efficiency and the increasing adoption of alternative forms of energy. Some value-oriented investors see beaten-down energy stocks as tremendous buying opportunities. It is true that many oil shares are “cheap” relative to historical levels. Low valuations abound in the sector, and many of the larger producers pay attractive dividends. It is also true that the world’s economy will continue to rely upon oil for as long as the eye can see. But as growth investors, we are not tempted. As we wrote last June, JAG has found that oil prices correlate relatively highly to share prices in the sector. Therefore, a correct long-term bet on shares of individual Energy-sector companies requires – all else being equal – an investor to correctly forecast the long-term trend of oil prices. Barring a war or geopolitical event that would materially crimp supplies or a dramatic uptick in global demand, we find it difficult to make a case for a sustained uptrend in crude oil prices. In the absence of such an uptrend in the price of the underlying commodity, we think Energy stocks will continue to languish.