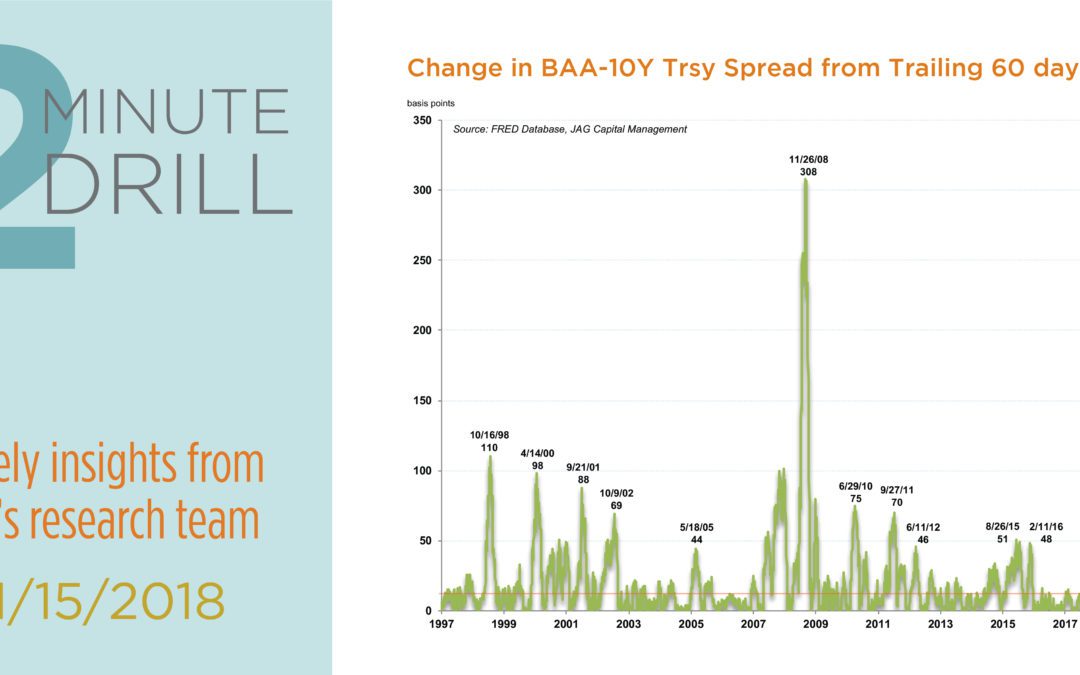

Is the current stock market correction destined to turn into a full-fledged bear market? No one knows for certain, but experience teaches us that bear markets in stocks tend to be preceded by signs of stress in the credit markets. This is because market and/or economic fears compel bond investors (i.e. lenders) to demand more yield to compensate them for the higher probability that they will not be repaid. This phenomenon can be observed by comparing the change in yield spreads between various types of bonds. Rising yield spreads correlate to higher levels of fear in the capital markets. Conversely, falling yield spreads indicate lower levels of fear.

The current correction in stocks began in late September and accelerated into late October, and it brought the S&P 500 down as much as 9.5% in the process. These charts show the path of yield spreads for both BAA-rated (investment grade) and CCC-rated (“junk”) bonds over the past 20+ years through November 9. Perhaps unsurprisingly, both charts show that yield spreads have recently widened along with equity market volatility. But importantly, we note that spreads have thus far remained much more subdued than in prior corrections in 2011, 2012, 2014, and 2016. We will be watching this data closely over the next several weeks. If the widening in yield spreads remains contained, we think the odds would favor continued stabilization in the broader stock market averages. On the other hand, if spreads widen dramatically, it is likely that stocks will have a rougher go of things in the near/ intermediate-term.