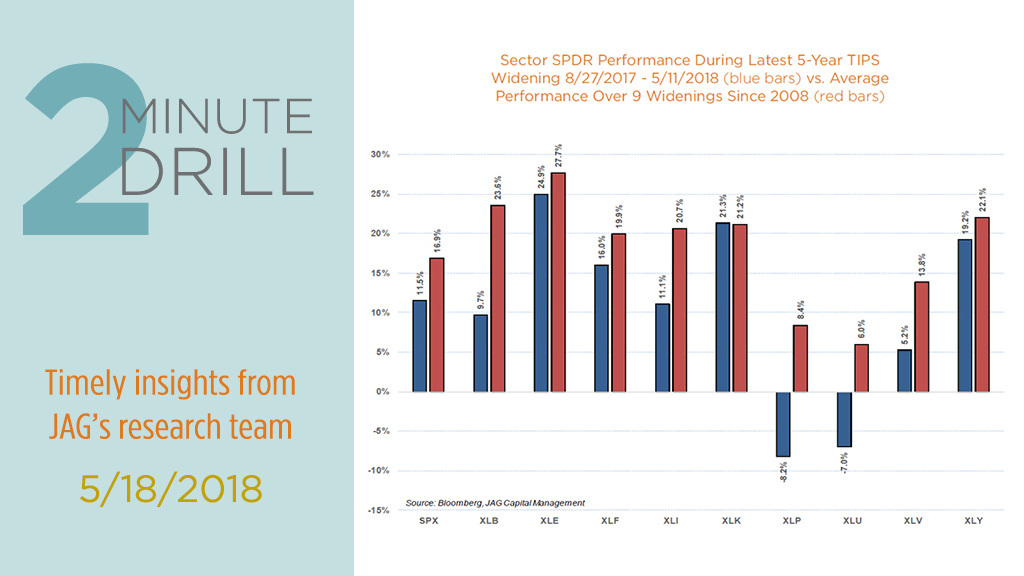

TIPS spreads have been rising since last summer, which indicates that inflationary pressures may finally be brewing in the economy. While rising inflation expectations have tended to be good for the broader market over the past 10 years (denoted by SPX on the chart), it has favored some sectors more than others. On average (red bars) and since last August (blue bars), Energy, Information Technology, and Consumer Discretionary stocks have experienced the biggest gains when 5-year TIPS spreads are increasing. However, Consumer Staples and Utilities both stick out as negative outliers in the most recent period. Both groups include many blue-chip companies that pay competitive and reliable dividends, but those yields are worth less to investors in a rising rate environment. And particularly in the case of Consumer Staples stocks, rising inflation also increases costs of their raw materials. Until and unless the economy slows and/or interest rates ease lower, we think these two traditional “safe ports” will continue to be challenging to navigate.