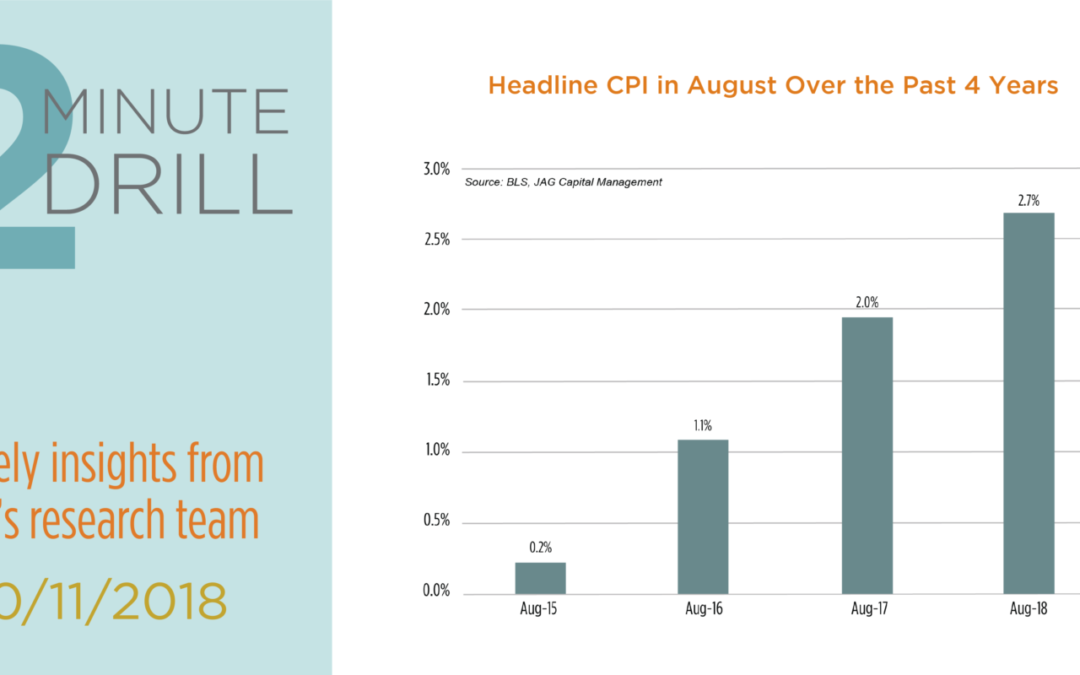

The level of inflation has been a subject of debate over the last several months. We prefer to focus on year over year changes in CPI to get a better feel of what is truly happening to prices. As you can see above, Headline CPI has steadily increased from 0.2% in August of 2015 to 2.7% this August. We view the steadily rising level of inflation as reasonable support for the ongoing Fed normalization effort, especially given that other portions of the economy pretty look healthy.

However, we acknowledge that higher inflation can make some investors nervous. We think this nervousness is at least part of the explanation for the last two weeks of skittish market action. We have been asking ourselves what investors look for when inflation concerns are rising. Our answer: businesses that reliably generate cash and can push through price increases to customers. The areas of the market that have worked for the last few weeks seem to align with that thought. Randgold Resources is up nearly 20% since September lows, the Energy sector has held up relatively well, Consumer Staples and Healthcare look increasingly attractive given their ability to generate a steady stream of cash. We think that steady inflation pressure could continue, and we are reacting appropriately by focusing on strong cash generators that have pricing power.