Which health care industries are most at risk of disruption by Amazon?

Health Care sector stocks, as tracked by the XLV Sector SPDR, are posting some ugly relative performance this year. This has come as a surprise to us at JAG, as earlier this year we thought the group looked attractive. Looks like we were wrong. Many of the larger biotechnology stocks cannot get out of their own way, despite a friendlier FDA approval regime under President Trump. Big pharmaceutical stocks are generally weak, as patent expirations loom, competition is increasing, and drug price pressures continue. And the hospital, PBM and medical distribution groups are faltering, as it looks like they are on the brink of becoming the scapegoats for price inflation in health care goods and services.

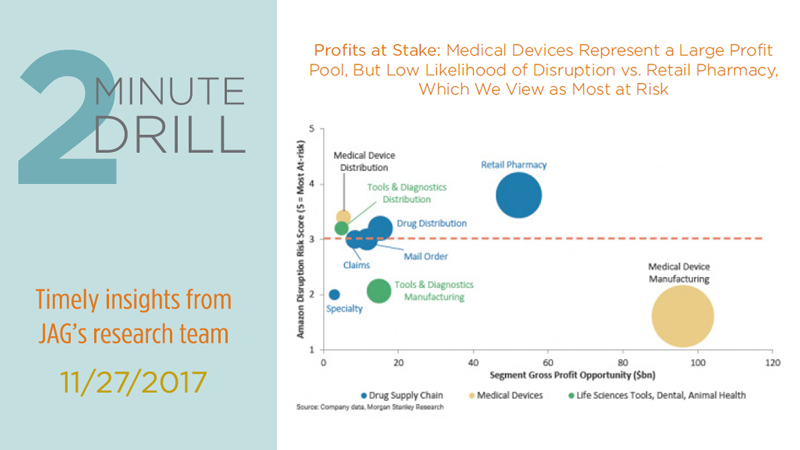

As anyone who has ever examined an Explanation of Benefits (EOB) form knows, the delivery of health care services in the United States is rife with friction and complexity. A typical prescription passes through several hands – each of which extracts a fee – before ever reaching the patient. The abundance of middlemen involved in delivering health care is ripe for disruption. Morgan Stanley Research put together this bubble chart juxtaposing margins and profits of various health care industries against their assessment of the risk of disruption by Amazon. They view medical device manufacturers as being at low risk of disruption, but retail pharmacy is another story altogether. We think Morgan Stanley is spot-on here, and we expect Amazon to target that big fat Pharmacy profit pool in the coming years.