As an investor, does the recent volatility feel especially bad to you? If so, this may be an example of Recency Bias, which is a behavioral anomaly hard-wired into all of us over thousands of generations of evolution. Recency Bias is the tendency of people to think that the trends we have observed in the recent past will continue in the future.

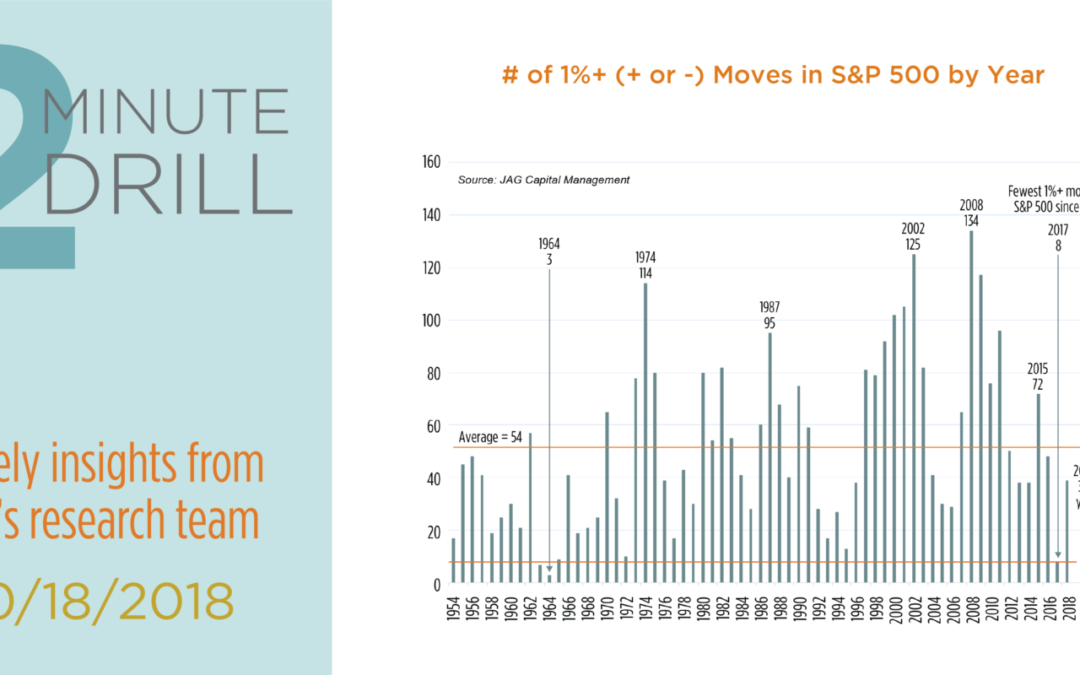

Since 1954, the S&P 500 has experienced an average of 54 daily moves of a least +/- 1% or greater moves each year. But since 2016, volatility has been lower. In 2017 there were only 8 daily moves of at least +/- 1%, the fewest since 1972. While it is true that 2018 has been much more volatile than 2017, note that the market is still experiencing below-average price volatility compared to the past 6+ decades of history.

The takeaway for investors? Although the past few years have been abnormally steady, price volatility is a feature, not a bug for equity investors. Volatile prices indicate risk, and embedded risk is why long-term stock investors can have the opportunity to earn returns greater than the risk-free rate.

Consumer shopping preferences have been evolving for many years. Although the old “big box” model for retailers dominated the 20th Century, non-store retailers have represented a bigger share of US Retail Sales since late 2002.

This tectonic shift is predominantly due to the rise of e-commerce (online) sales, led by companies like Amazon (AMZN). While there will likely always be room for so-called “brick and mortar” stores, it is clear that the war between department stores and e-commerce has been over for almost two decades now.