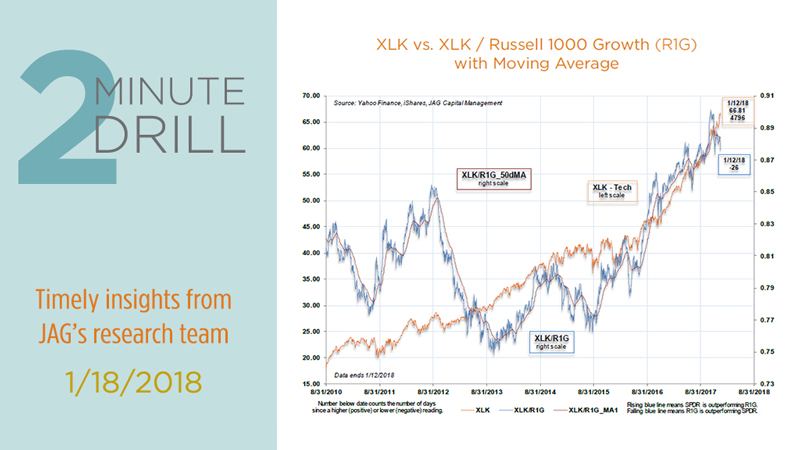

Although the Technology sector’s strong performance in 2017 got lots of attention, Tech has been exhibiting strong relative performance since way back in 2013. As a group, these companies are growing much faster than the broader market, have defensible and expanding margins, and are disrupting an increasing proportion of consumer and enterprise spending worldwide. We expect more volatility this year than last, but Tech remains our favorite hunting ground in 2018.

Energy, Financials, and Technology stocks have been getting the most love from analysts over the past few months. Energy sector earnings revisions for Q1 ’18 are up almost 14%, owing to firmer oil prices and low year-over-year comparisons. Analysts expect Financials sector earnings to benefit from an up-tick in interest rates. We think the ramp in Technology sector estimates is a recognition by analysts that many areas of the Tech sector are in secular (not cyclical) growth modes, combined with some tailwind effects from the recently-signed corporate tax reform package.

According to Bespoke Investment Group and data from the NY Fed, we are now seeing the largest 2-month increase in technology-related capital expenditure plans since 2011. This metric has only been higher on 3 other occasions since 2001. Our educated guess is that the ramp in tech-related capex is being heavily driven by datacenter and security spending.

According to Bespoke, big two-month spikes in tech spending plans tend to be followed by strong broad equity market performance, and even stronger Technology sector performance. To the extent that 2018 plays out similarly to the previous instances in history, this data makes us incrementally more bullish on Tech stocks in the coming year.