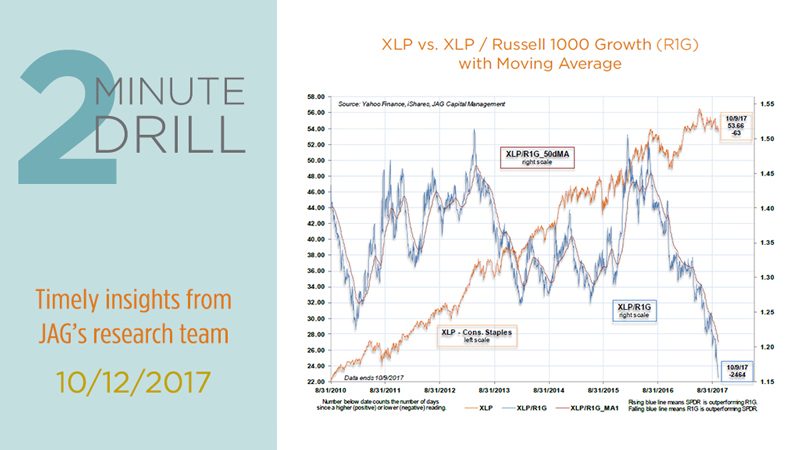

Consumer Staples stocks are now at an almost 10-year low versus the R1G Index.

Yikes, we don’t see this sort of chart very often! On a relative strength basis, Consumer Staples stocks are now at an almost 10-year low versus the Russell 1000 Growth Index. This is a great example of what “out of favor” looks like. There are probably some good values developing in the packaged food stocks. Big global brands are under pressure due to changing consumer preferences and online distribution, but we don’t think they are all going out of business anytime soon. That said, many Consumer Staples stocks are still richly valued at 20+x earnings with low single-digit growth rates. Also, this degree of underperformance implies that there could be some deeper-rooted problems in the group. Be careful out there.

There is hope for those of us who are looking for a little bit more inflation. The price indexes of the ISM Manufacturing and Non-Manufacturing indexes are hitting multi-year high’s. In the case of the Non-Manufacturing price index, it is now at the highest levels since 2011. This makes sense, as global economic activity continues to perk along, and wage growth is beginning to firm in the U.S. We think a little bit more inflation would be a good thing for the economy and give some breathing room to policymakers at the Fed.