The last few months of 2018 was characterized by widespread fears of slowing global economic growth, which was exacerbated by the U.S. Federal Reserve’s commitment to rate increases. Translation: 2018 provided an excellent example of the type of market backdrop that favors defensive stocks.

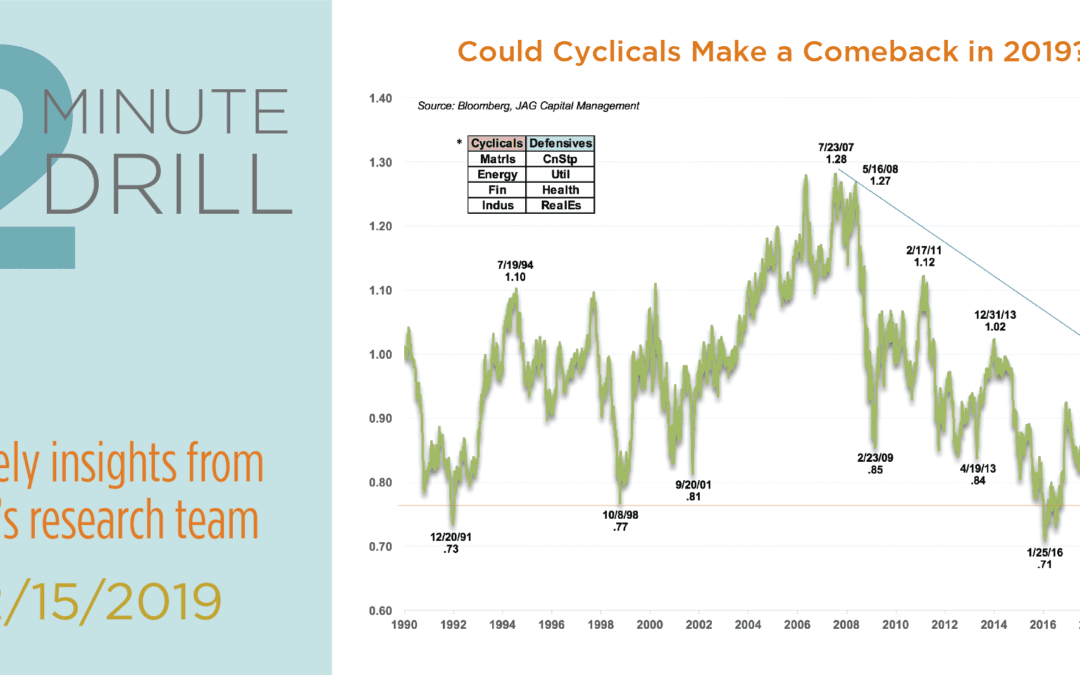

In fact, by 12/24/18, the sell-off in cyclical stocks had become historically extreme, as cyclicals vs. defensives relative performance plumbed depths rarely seen since 1990. As this graph shows, periods of extreme out performance by defensive stocks tend to be followed by periods of cyclical outperformance, and vice-versa. JAG believes that capital may once again flow into cyclicals as we move into 2019 and potentially into 2020. Valuations are reasonable, investor sentiment is poor, the technical setup appears favorable, and the Fed now appears to be on hold. This could create an environment in which selected Industrials, Financials and Materials stocks offer more attractive reward-to-risk opportunities than have existed since early 2016. We are less sanguine on the prospects for much of the Energy sector, given robust supplies for crude oil and declining global demand growth.