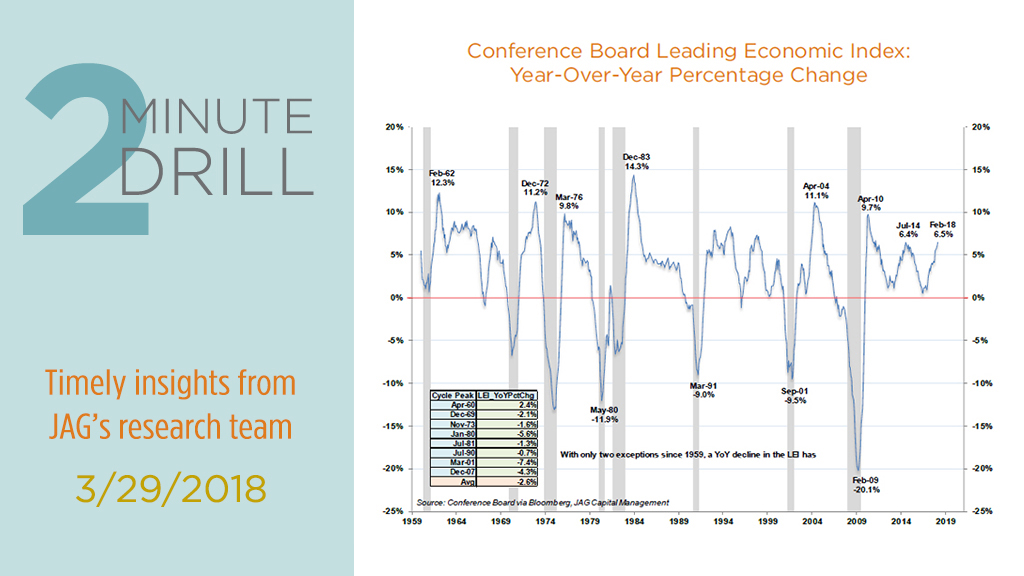

Recent price volatility has kicked many stocks into correction territory (i.e. down 10%+ from recent highs), which is causing some observers to worry that the equity market is discounting future weakness in the broader economy. While anything is possible, we don’t see any tangible signs of a recession on the near-to-intermediate horizon. Note that the Leading Economic Index (LEI) has increased by 6.5% year-over-year and is breaking out to multi-year highs. Past economic cycle peaks (noted in the table inside the chart) have generally occurred after the rate of growth in the LEI has contracted into negative territory. Barring an unexpected (and rapid) deterioration in the economy, we tend to view the market’s correction as more of an opportunity than a threat.

New Orders for Core Durable Goods have been firming since early 2016. The last two recessions (2001-2002 and 2008-2009) were presaged by negative rates of growth in this key metric. Given the fact that the economy did not slip into recession after poor durable goods orders in April 2013 and February 2016, a cynic might note that this metric has predicted four of the last two recessions. But the fact remains that significant economic contraction is unlikely as long as new orders for durable goods stay in positive territory. Remember that stock prices can correct at any time, for any reason, or even for no reason! This is why equities are considered risky assets. Investors with long time horizons would do well to remember that stocks’ volatility risk fuels the long-term return premium enjoyed by equities versus fixed income and cash assets.