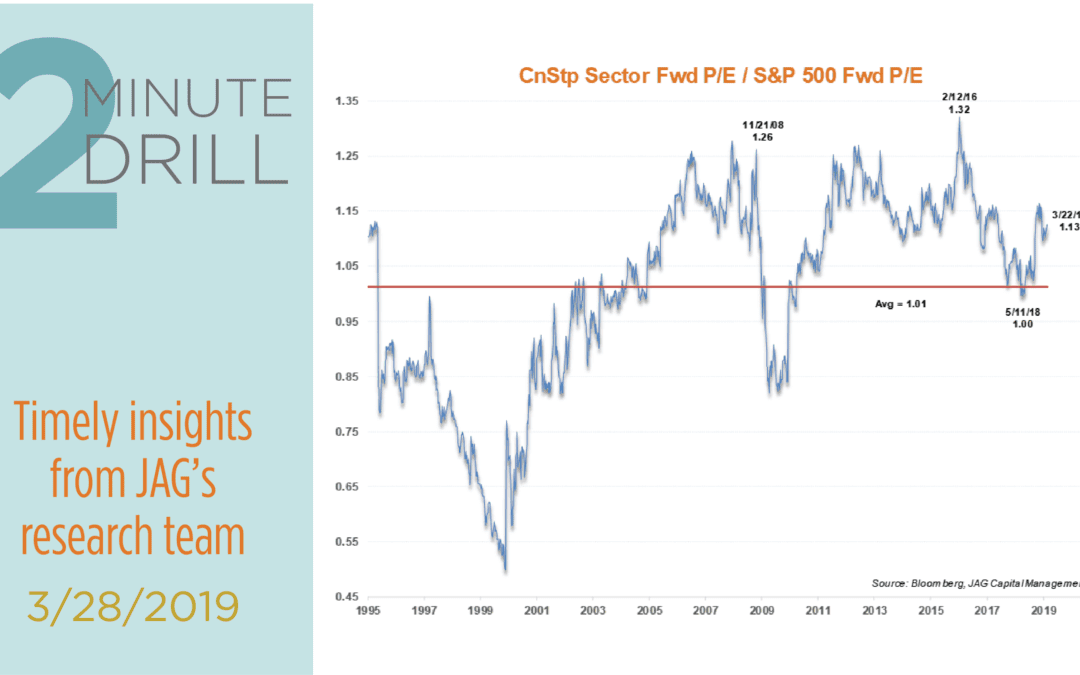

Consumer Staples Fwd P/E / S&P 500 Fwd P/E Chart

The S&P 500 Consumer Staples sector has declined by almost 5% so far in 2019, continuing a trend of disappointing returns over the past several years. In fact, the S&P 500 Consumer Staples Sector SPDR is trading at the same levels it was in the summer of 2016, versus the 30%+ gain for the broader S&P 500 Index over the same timeframe. Historically, this type of dramatic sector underperformance tends to result in more attractive valuations. For example, Financials sector performance has been poor since early 2018, but the sector now trades at a 33% discount to the S&P on forward earnings. Similarly, Materials have been poor relative performers since late 2017, but the sector now trades at a roughly 6% discount by the same metric. As this chart shows, however, Consumer Staples continue to command a 13% premium to the S&P 500, based upon forward earnings estimates. Although this “safe haven” sector is relatively cheaper than it was in late 2008 and early 2016, investors appear stubbornly willing to pay up for the relative earnings stability that many sector constituents offer. We don’t agree. For our part, we see little reason to pay a premium price for slow (but steady) growth. Many Consumer Staples companies trade at 20x+ earnings for sub-5% revenue growth, which we find to be an unappealing combination. We remain underweight.