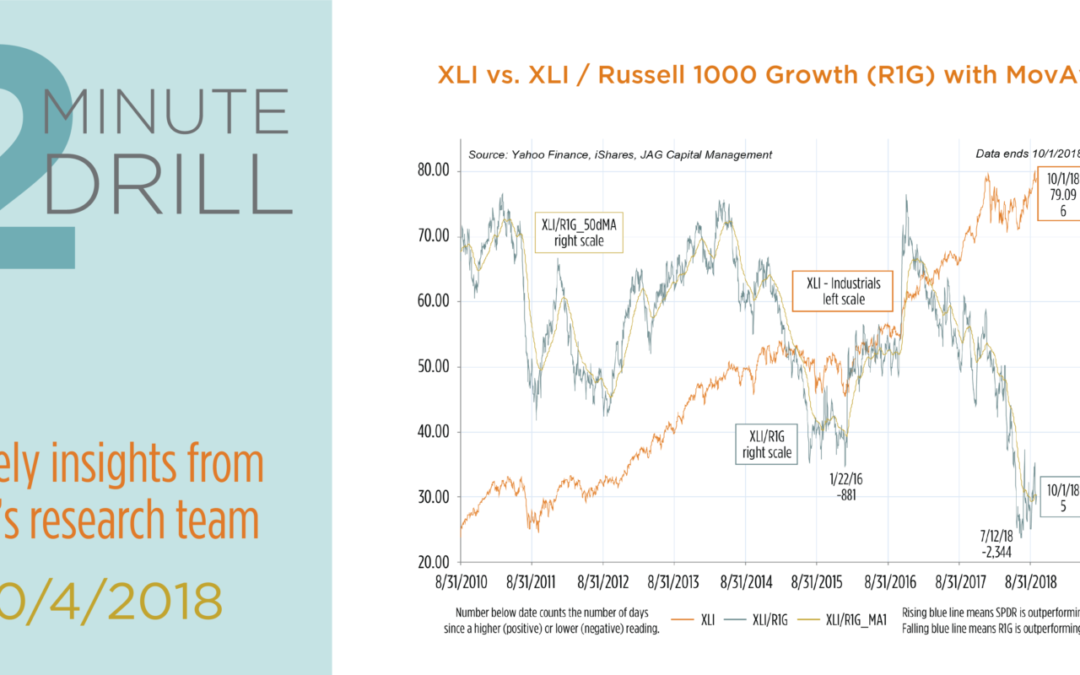

A little over two months ago, we noted how poorly the Industrials sector was performing. We noted that tariff threats, a strong dollar, and rising input costs were headwinds. However, after hitting a 2,344-day relative strength low versus the Russell 1000 Growth Index in mid-July, Industrials seem to be making a stand. In fact, Industrials were the 3rd-best performing sector in the Russell 1000 Growth index for the 3rd quarter, generating returns of almost 11% (Only the Tech and Healthcare sectors did better). It seems to us that investors are beginning to sense that the risks of a global, multi-front trade war are subsiding. The recent USMCA agreement (“New NAFTA”) seems likely to calm tensions between the US, Mexico, and Canada. Add to this the US/South Korea trade accord and progress in talks with the EU, and we are left with China as the only major remaining flash-point in trade. If the Trump Administration is able to negotiate a deal with China in the coming months, we think the rally in Industrials could have room to run into 2019.

With a 12.8% quarterly gain, the Healthcare sector’s third quarter performance was second only to Technology. We think concerns over the political risks (i.e. drug pricing) are beginning to abate. Also, after three years of relative underperformance, valuations are relatively attractive in many areas of the group, including biotechnology and pharmaceuticals. Many Healthcare constituents have rock-solid balance sheets, good product pipelines, and strong margins. Our aging population ensures that demand for drugs and medical devices will remain high. And historically, Healthcare stocks tend to have defensive characteristics, particularly during Fed rate-hike cycles. We continue to view this sector as a great hunting ground for growth-oriented investors.