Firm Highlights

- Welcome George & Adam!

George Margvelashvili, CFA® joined JAG as an Equity Research Analyst focusing on companies within the technology sector. George previously worked at Fisher Investments as a research analyst primarily covering semiconductor companies. Prior to joining the investment management industry, George was a professional chess player and in 2010 was awarded the Grandmaster title — the highest title a chess player can attain. - Adam Dobin joined JAG as an Investment Operations Specialist. Bringing over 20 years of industry experience, Adam supports JAG’s equity trading, reconciliation, and reporting functions. Adam previously worked at TortoiseEcofin Investments, Inc where he was responsible for core operational systems.

Retrospectives and Perspectives for The New Year

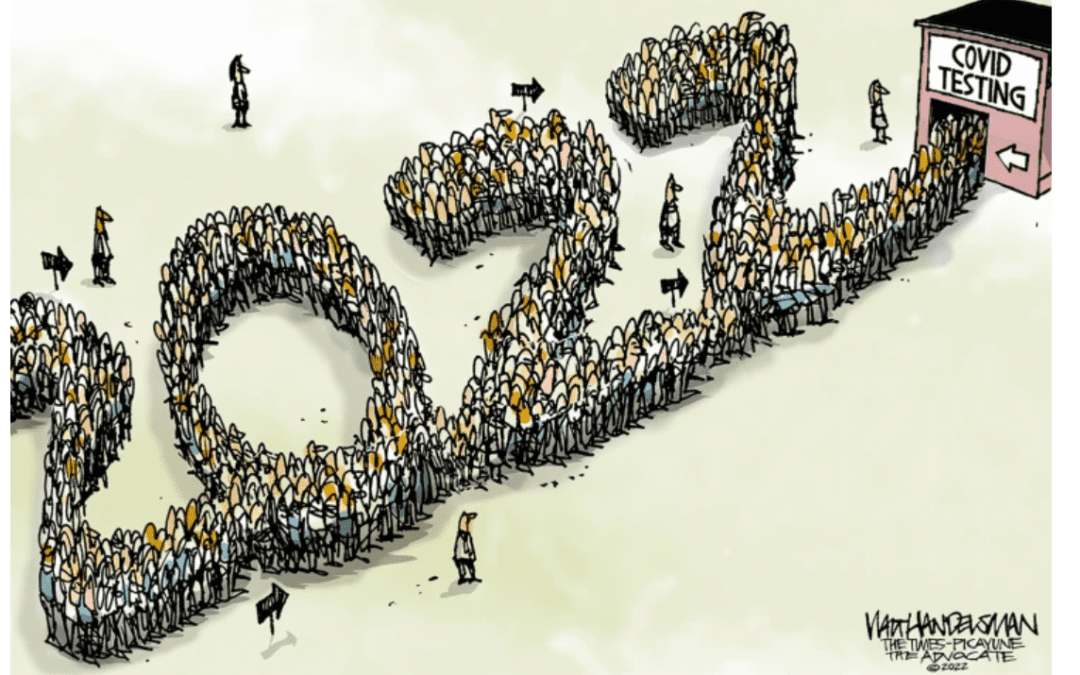

Stocks ramped into year end, notching 2021 as another triumph for the optimists. The S&P 500 logged its third straight calendar year of double-digit returns, despite a resurgence of COVID-19 via the Omicron variant and growing concern over higher interest rates and inflation. Surprisingly — at least to us — corporate earnings growth has been extraordinarily robust over the past year. According to FactSet, the S&P 500 ended 2021 with 36.7% annual earnings growth to trade at 21.1x estimated 2022 earnings of $225.62. This means the index’s forward earnings multiple contracted by 7% year-over-year, a relatively rare occurrence during bull markets.