What a year we had in 2016! As a group, experts and prognosticators across the political and investing realms have never been so spectacularly wrong about so many things. Here is just a short list of some of the more confounding events of last year:

- U.S. stocks delivered flattish returns in 2015, and began 2016 with their worst start to a calendar year in history. The S&P 500 crumpled by 11% between New Year’s and mid-February, leading many strategists to warn of further declines. Stocks turned on a dime and began their recovery in March. After marking time leading up to the election, the market ramped into year-end to finish 2016 solidly in positive territory.

- Oil and commodity prices plumbed new lows in early 2016, feeding investor fears of deflation and widespread credit defaults in energy sector bonds. But after dipping below $30/barrel in January 2016, oil prices stabilized and closed the year north of $50/barrel. High yield bonds – a category heavy in the debt of energy and commodity-related companies – returned more than 15% and were the best-performing asset class in the market last year.

- In June, UK voters astonished political pundits everywhere by voting to leave the European Union. Global stocks sold off hard for all of 48 hours as investors fretted about the short- and long-term implications of “Brexit.” Stocks regained all of those losses and more, staging new all-time highs within two weeks.

- The U.S. Presidential election results were the very embodiment of a surprise. None of the major polling services predicted a win by Trump, and almost all media commentators refused to seriously entertain the possibility that Mrs. Clinton might lose her bid to become the first female U.S. President. To the extent that investment strategists opined on the election at all, they prophesied that a (very) unlikely Trump victory would kick off a significant fall in stock prices and a decline in Treasury yields. Of course, exactly the opposite occurred. Trump won, stocks gained, and Treasury yields rose.

- Interest rates flummoxed basically everyone in 2016. The 10-year US Treasury yield started the year at 2.3%, before sluggish economic data and lower inflation statistics drove yields down to a multi-generational low of 1.39% in July. Then rates reversed course as the economy appeared to improve and inflation began to perk up. Yields ramped to close the year out at 2.5%. For the full year, the net change in 10-year yields was a modest increase of .2%, but their path along the way was as circuitous as markets have ever seen.

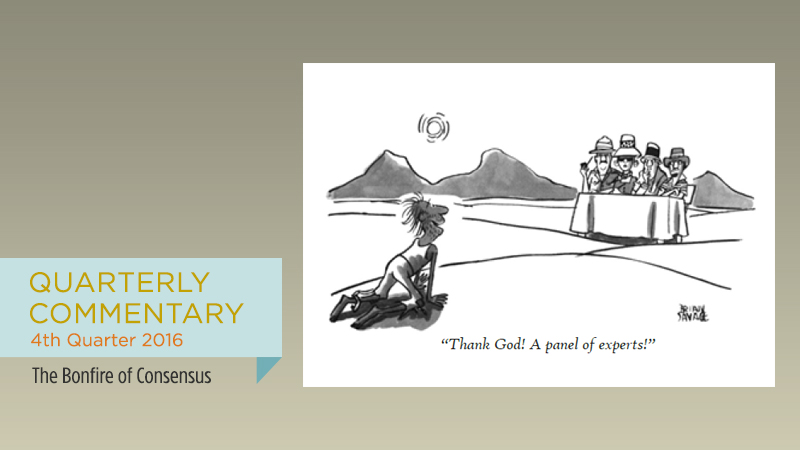

Last year showed us lots of examples of events straying from consensus expectations. But should this be considered “surprising” at all? Probably not. Note that those who make their living predicting markets or election results generally rely heavily upon their reputations to further their careers. When making their forecasts, they are naturally aware of their peers’ projections. The farther their forecasts vary from those in their cohort, the bigger the risk that they will look spectacularly wrong compared to everyone else. Obviously, for someone in the business of making predictions, being dead wrong can be disastrous to one’s professional reputation. Therefore, experts in a variety of fields tend to exhibit “herding” behavior, in the sense that their predictions and observations tend to be relatively similar to one another. As an investor, being aware of this tendency can help one avoid the perils of consensus thinking.