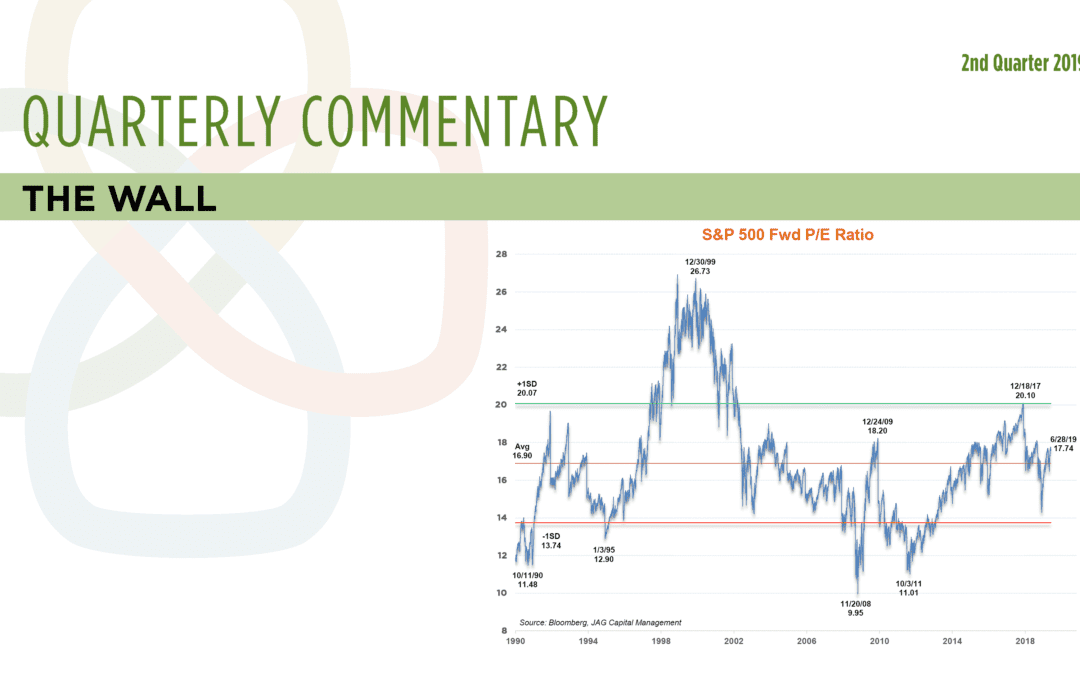

As most of our clients and friends are aware, we do not make stock market forecasts. In fact, we believe short-term market prognostications are almost always unworthy of the time spent to produce or consume them, as we do not think anyone can reliably predict gyrations in asset prices in advance. That said, we can and do provide our clients with some insight into how we are approaching the investment environment. From a valuation perspective, we see the broader equity market as being reasonably valued. At roughly 18x forward earnings, the S&P 500 is currently valued at a slight premium to its average forward multiple of 16.9x since 1990. By this same metric, the broader market has been valued as highly as 26.7x (December 1999), and as low as 10x (November 2008).

While it is obvious with 20/20 hindsight that stocks were “too expensive”

in late 1999 and “too cheap” in late 2008, we do not think today’s valuations contain much predictive value. About the most we can say is that stocks remain attractively valued relative to, for example, Treasury bonds. At a current yield of 2%, an investor in 10-year U.S. Treasury notes will pay 50x earnings for an asset that is guaranteed to return nothing more than par value at maturity. By way of contrast, an investment in the S&P 500 can be made at less than 20x forward earnings and offers a dividend yield of almost 2%/year, along with the potential for long-term capital appreciation. Although investors in the S&P 500 have no guarantee that they will not lose principal over the next decade, we think they are highly likely to fare much better than an investor in Treasuries between now and 2029. We readily admit that this statement, even if proven true, says nothing about whether U.S. stocks will be higher or lower over the next several months. On that score, we think the current state of investor sentiment may offer a bit more in the way of clues.