To paraphrase legendary investor Ken Fisher, yearly stock market returns can be divided into four simple categories. Stocks can be up a lot (10%+), up a little (between 0% and 10%), down a little (between 0% and -10%), or down a lot (fall by more than 10%). Thankfully for long-term investors, “up a lot” years are relatively common. The S&P 500 experienced gains of greater than 10% in 52 of the last 91 calendar years, including 2017. Sure, there have been some brutal down years, including 2008 most recently. But happily, such disasters are rare, and they have created attractive buying opportunities for disciplined investors.

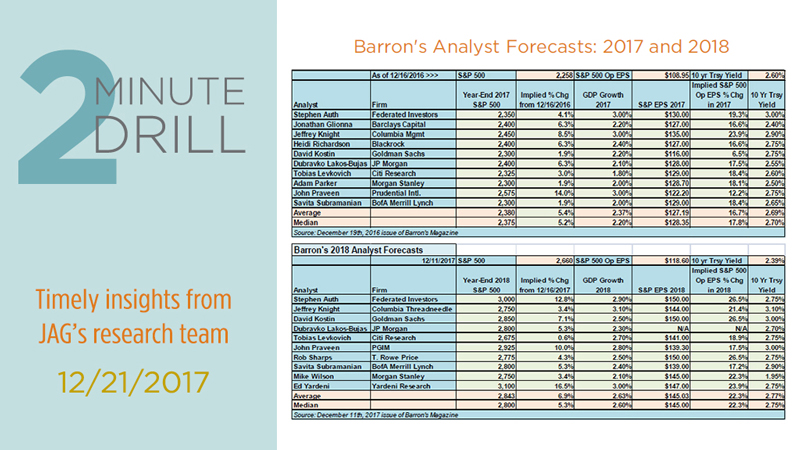

On average, the 10 analysts polled by Barron’s this time last year predicted the S&P 500 to rise only 5.4% in 2017. Whoops! As is often the case, the smartest folks on Wall Street proved they can be fallible. While they correctly predicted the general direction of stock prices (up), they did not come close to foreseeing the magnitude of gains we have experienced this year. Understand that we are not maligning investment strategists. They are almost uniformly intelligent, dedicated, and hard-working professionals. Unfortunately, they have all been trained and educated similarly, and they tend to rely upon almost identical data to inform their forecasts. Consequently, their market predictions tend to be tightly grouped with one another. So, it should come as no surprise that their 2018 are again clustered around “up a little” prediction for stocks. The Barron’s 2018 Analyst Survey’s average prediction calls for a roughly 7% gain for the S&P 500 next year. If history is any guide, the market is likely to either undershoot or overshoot this consensus expectation.

Since 1926, the S&P 500 has had 52 “up a lot” calendar years, including 2017. So what has tended to happen the following year? Somewhat surprisingly, the most common outcome after a big up year has been yet another year of strong gains. This has occurred 29 times, or in 55.8% of the cases. Could the market be down a lot in 2018? Sure! Anything can happen in the capital markets. But historically speaking, strong yearly gains have been following by big declines only 3 times. Let’s call that what it is: a low-probability outcome. As we have already discussed, Wall Street expects modest gains in 2018, but that has only occurred 9 times, or in 17.3% of instances. In our opinion, the historical probabilities favor a continuation of the bull market trend through 2018 for next year, to an extent that could (again) surpass consensus expectations.