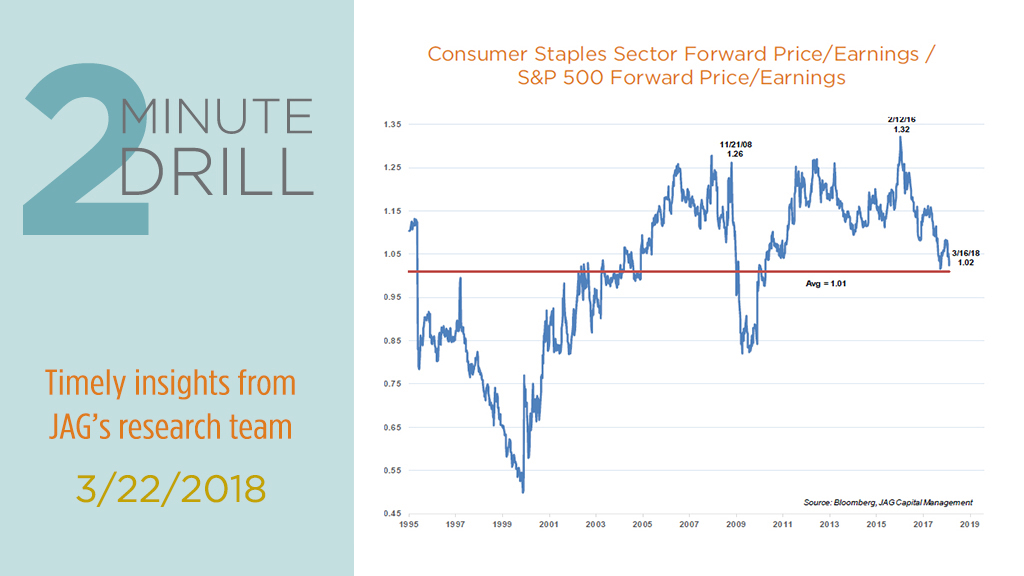

The Consumer Staples sector has been a noticeable laggard for quite some time. As measured by the Sector SPDR ETF (symbol: XLP), the group’s annualized returns over the past five years has fallen more than 500 basis points short of the S&P 500’s. So far in 2018, the Staples sector is taking a -7% shellacking, compared to a 2%+ gain for the S&P. So, is this a good time for contrarian investors to jump into a hated sector? We think not. Somewhat surprisingly given its protracted performance slump, the Consumer Staples sector remains expensive compared to the broader market. Given the group’s unappetizing revenue and earnings growth potential, margin pressures stemming from a global shift to online consumption, and historical precedent (see chart to left), we could see relative valuations compress much further in the future.

As measured by the XLF Sector SPDR, Financials have handily outperformed the broader market handily over the past 1, 3, and 5 years. Despite this fact, the Financials sector remains cheap relative to the broader market, and we continue to like its prospects. Rising interest rates and the growing economy should translate into better earnings, the regulatory environment is more accommodating than it has been in a decade, and we expect to see shareholder-friendly consolidation in the banking sector. Furthermore, we see the Financials as being potentially attractive to a wide constituency of investors, encompassing growth, value, and even momentum-oriented styles. Color us bullish!

The Health Care sector’s relative performance has been poor for several years. In fact, the XLV Sector SPDR recently logged a new five-year relative strength low compared to the S&P 500. Unlike Consumer Staples, valuations in Health Care are relatively attractive when compared to the S&P 500. This is all well and good, but the group also faces challenges ranging from drug price pressures, health care reform, and regulatory risks. We see this as a “pick your spots” sector for active investors. Accordingly, our team is focusing on selecting biotechnology companies, diagnostic innovators, and device manufacturers. At the same time, we are doing our best to avoid companies which stand to lose margin or market share as the U.S. health care landscape evolves over the coming few years.

The Technology sector remains our favorite hunting ground. The group sports lots of examples of companies which are producing powerful innovations, strong top and bottom line growth, stable and rising margins, and the opportunity to scale their products and services globally. And even though tech has dramatically outperformed the S&P 500 for the last 1, 3, 5, and 10 years, the sector’s valuation remains undemanding compared to the broader market. We think truly long-term investors will be well-served by maintaining a healthy exposure to technology stocks. In our opinion, this sector contains the best opportunities for wealth creation over next several decades.