September 30, 2023

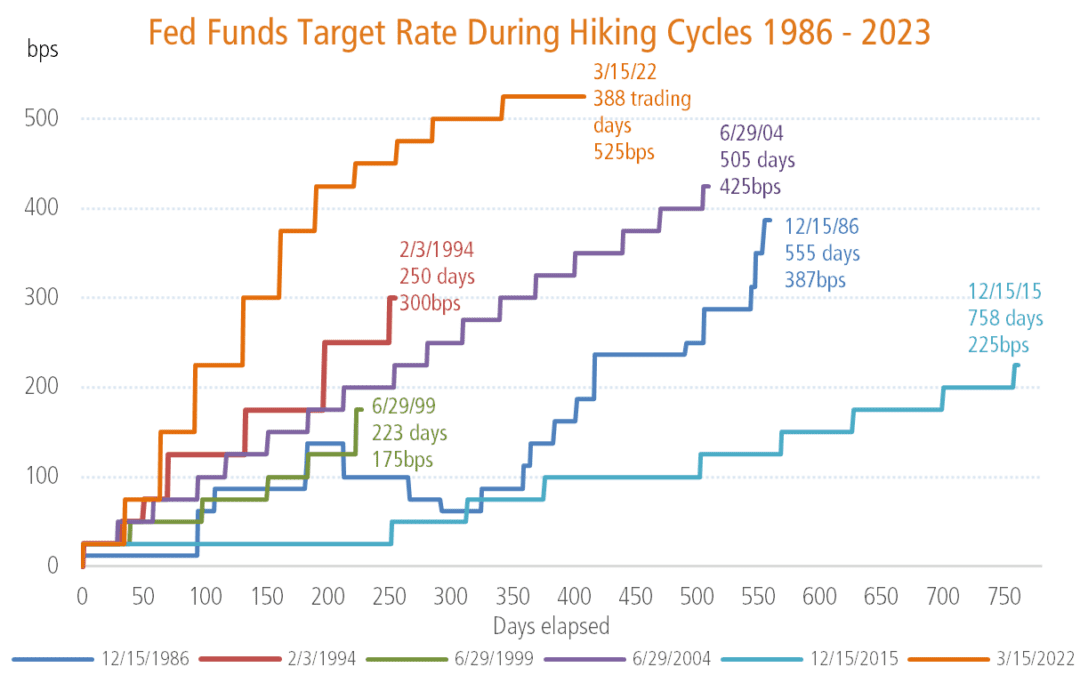

Capital markets have been put through the wringer since the Fed started their rake hike cycle, resulting in many fixed income portfolios failing to achieve their stabilizing role in investors’ asset allocations. The Fed, by its own admission, was late recognizing the severity and persistence of inflation. Behind the curve, but determined to catch up, they have embarked on the fastest and steepest series of rate hikes in modern history. Consequently, fixed income markets have suffered their worst performance in over 100 years, with the Bloomberg Global Aggregate Bond Index plummeting more than 24% from its all-time high. Despite the anguish the rate hikes have inflicted on fixed income investors, we believe this historic bear market creates the greatest opportunity for total return in bonds since the Great Recession.