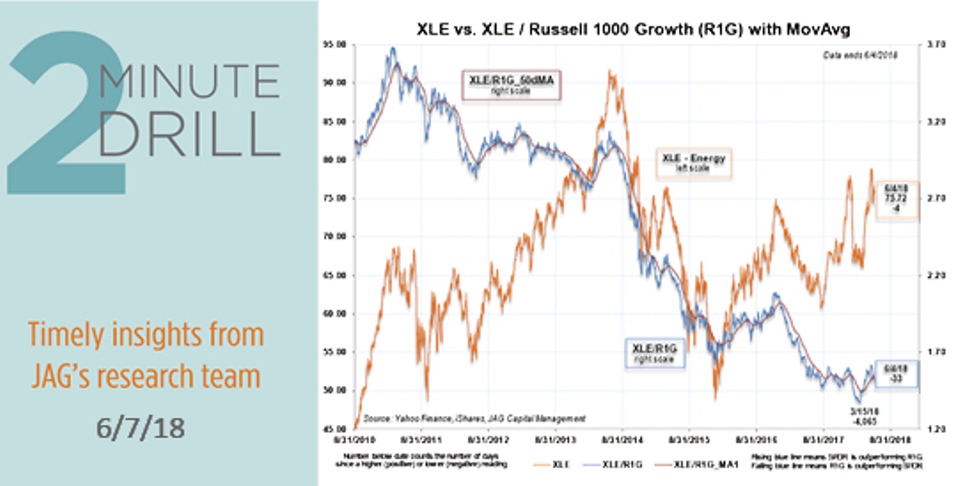

The Energy sector has been a difficult place to invest over the past several years. We have been bearish on the group since 2014, as we view exploding US shale oil production as a destabilizing force that undermines the traditional “price making” power of OPEC. We also think that long-term demand growth for petroleum products could be lower than many expect, given the global embrace of more fuel-efficient vehicles and alternative forms of energy. Indeed, as it turns out, the past five years have been to be relatively negative on Energy stocks. Since the summer of 2013, the Energy Sector SPDR ETF (XLE), has produced annualized returns of approximately 1.4%, which pales in comparison to the 12%+ five-year annualized returns generated by the S&P 500 Index. However, both oil prices and many energy-producing stocks have rallied more recently. XLE has gained almost 10% over the past month, which dwarfs the slight loss in the S&P 500 over the same timeframe. This begs the question for growth-oriented equity investors like us: is this the beginning of a longer period of outperformance for a long-depressed market sector? For now, we don’t think so. Particularly as relates to oil exploration & production companies, JAG has found that oil prices correlate relatively highly to share prices in the sector. Therefore, a correct long-term bet on shares of individual Energy-sector companies requires – all else being equal – an investor to correctly forecast the long-term trend of oil prices. Barring a war or geopolitical event that would materially crimp supplies or a dramatic uptick in global demand, we find it difficult to make a case for sustained $100/barrel crude oil. We will continue to monitor the group closely, but for now, we find ourselves staying comfy in our seats on the sidelines.