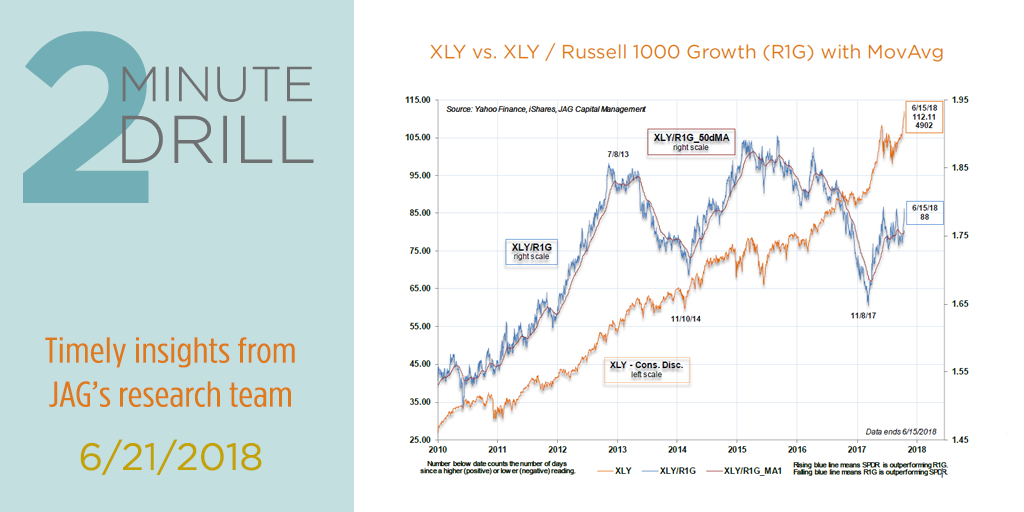

The Consumer Discretionary sector has been generally gaining relative strength versus the Russell 1000 Growth Index since last November. There is little question that much of the sector’s strength is being driven by ecommerce companies like Amazon and Netflix, but recently we have noticed some broadening participation in the group. For example, luxury goods and specialty retailers have been doing well over the past several weeks. We know from the employment data that most people have jobs, and there are emerging signs of wage inflation. Therefore, more consumers may be finding themselves in a “spending mood.”

Recent predictions from various Federal Reserve banks are leading to projections of 4.8% GDP growth in the 2nd quarter. If it comes to pass, that would be the highest quarterly GDP growth since 3Q 2014, and the second-highest since 2006. It would also represent 3.25% year-over-year growth in real GDP, continuing the trend of economic acceleration that began in mid-2016.

According to the latest NFIB survey, small business owners are the most optimistic they have been since at least the mid-1980’s. They have also reported growth in actual earnings for the first time since 1985. According to government data, small businesses employ over 50% of the private, nonfarm workforce in the United States. Therefore, to the extent that small business owners are exhibiting historical levels of optimism, it is probable that will collectively represent a tailwind to continued strength in GDP.