Stocks got off to a strong start during the first quarter of 2017, albeit with a new cohort of leaders. As a reminder, cyclical stocks were the best performers during last year’s fourth quarter. Following the astonishing-to-most outcome of the Presidential election, capital rushed into the shares of companies which were perceived to be the biggest beneficiaries of President-elect Trump’s proposals to grow U.S. jobs, lower tax rates and slash regulations. Markets are dancing to a different tune so far this year. Breaking stride with the late-2016 pattern, the leaders in early 2017 have been growth companies in the Technology, Health Care and Consumer Discretionary sectors. Energy companies have slumped along with a pullback in oil prices, and the commodity-heavy Materials sector has also lagged the broader market in recent weeks.

Part of the market’s “attitude adjustment” in 2017 can be ascribed to the collision between rhetoric and reality in Washington DC. President Trump’s ambitious policy agenda is now beginning to be bogged down in the morass of partisan politics in Washington. Crafting and passing transformative legislation is – and always has been – a messy business, even when a single party controls both houses of Congress and the Oval Office. Although the President chose to attack healthcare reform first, it turned out his bill was not able to garner enough votes to ensure passage through Congress. Now that his plans to “repeal and replace” the Affordable Care Act have gone back to the drawing board, Trump has decided to pivot to restructuring corporate and individual tax rates. We expect that these negotiations on tax reform will be contentious, and that they will likely drag on into the fall of 2017. In our opinion, the main investment takeaway from all of this is that the Trump Administration’s policy changes will take more time to execute than many investors expected (hoped) before Inauguration Day.

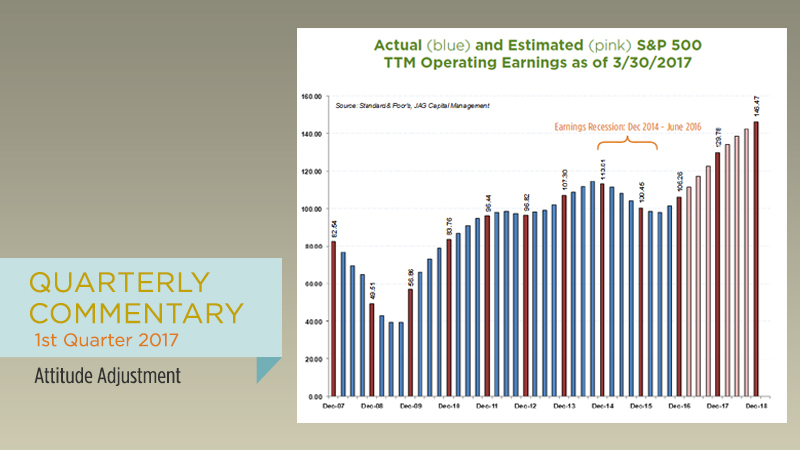

Stocks are not cheap, but this has been the case for several years. The S&P 500 has returned almost 37% over the past three years, despite the fact that corporate earnings are roughly flat over that time span.